Michael

Denver, CO

Grew up in the 70's, worked in finance for 15 years, dabbled in economic theory in school a little too much.

Here to share my insights on economics and finance!

Blog Posts by Michael:

- May 23, 2024

- by Michael

The Solo 401(k) Mistake That Can Cost You $250/day

If you have a Solo 401(k) that is worth more than $250k or was terminated make sure to file your 5500-EZ with the IRS or face fines of $250/day!!!

- November 30, 2023

- by Michael

Accredited Investor Requirements and Options

A special class of investments are only open to what are known as “accredited investors”. How does a person become an accredited investor and what can they invest in that ordinary people cannot? Do they …

- November 21, 2023

- by Michael

Social Media and Stock Market Trends

In the beginning, social networks were used for communication between friends and expressing personal opinions. Today, social networks are increasingly about brands, marketing, and influencers. A popular topic on social media is finance.

- October 17, 2023

- by Michael

Family Owned Business - Pros and Cons

If you are considering starting a family-owned business, you should research all the pros and cons of starting this type of business. How much better is it than working in a regular job for somebody …

- June 30, 2023

- by Michael

IRS Tax Code Updates 2023

You might want to check if your income puts you on a bubble where a tax credit that is valuable to you phases out, or a tax hike phases in Figures have been updated for …

- December 21, 2022

- by Michael

5 Reasons to Consider a Hire Purchase for Your Business

If you have a comprehensive business plan but lack the finances to acquire high-quality equipment to execute it, opting for a hire purchase / rent-to-own scheme can be a solid solution.

- November 15, 2022

- by Michael

Is Bitcoin Still A Great Asset for Investment?

The cryptocurrency market is very volatile. The price of Bitcoin can change by 20% in a day and even more in an hour. This means you have to be very patient when investing in this …

- October 18, 2022

- by Michael

Home Values and Rising Mortgage Rates

Mortgage rates have gone up over 4% between October 2021 and October 2022. Although nowhere near the peak of 18% in 1981, rates have not been higher since 2002. The housing market is about to …

- October 9, 2022

- by Michael

US Treasuries for Individual Investors

US Treasuries can sometimes offer a better rate of return vs conventional CDs or money market funds. Here is how they work.

- August 10, 2022

- by Michael

What Are Life Path / Target Date Funds?

As you get closer to the target date, the holdings in the fund shift from risky volatile high return assets (like stocks) into low risk, stable, low return assets (like bonds).

- June 16, 2022

- by Michael

Index Investing vs Dividend Investing

In this post we’ll consider two types of investing strategies. Dividend investing and index investing. While they are both part of a long term investment strategy there are some important differences.

- May 21, 2022

- by Michael

Understanding IRAs: The Complete Guide

IRAs, or Individual Retirement Accounts, are essentially savings plans that come with considerable tax breaks. Do not confuse them with investments. Instead, think of them as a safety deposit box where you can store paper …

- May 5, 2022

- by Michael

Must Read Personal Finance Books

Here is our list of top personal finance books you absolutely must read. Personal finance books explain precious tips to establish your productive relationship with money.

- April 14, 2022

- by Michael

What to Look for When Buying a Used Car

Buying a used car can be a risk if the car has many mechanical issues. For the sake of your budget you want to make sure you are not buying a money pit that needs …

- April 7, 2022

- by Michael

Ways to Let Your Kids Inherit Your House Tax-Free

When it comes to passing on inheritance, there are ways to do it tax-free. Specific tools, like a gift asset, a trust, or a will goes a long way in helping your heir avoid taxes.

- March 21, 2022

- by Michael

Short-Term vs. Long-Term Capital Gains

There are two types of capital gains to input on your taxes - short and long-term capital gains. Continue reading to delve into the differences between these types.

- March 9, 2022

- by Michael

Amazon Prime vs. Walmart Plus a Comparison

Who doesn’t like the idea of free shipping, next day delivery, 5% cash back, and the ability to choose thousands of premium goods all in one place? Here we compare Amazon Prime vs Walmart Plus.

- February 22, 2022

- by Michael

Social Security Colas: Everything You Wanted to Know

To combat the ill effects of inflation on people who are retired, a concept called ‘Cost of Living Adjustment’ (COLA) is used to help retirees keep up with rising costs. As a consumer, it is …

- January 20, 2022

- by Michael

The Top Strategies to Get Out of Debt

Debt can have an undesirable impact on anyone’s life. If you have piles of money to be paid, the thought of becoming debt free can be a tad too overwhelming. Here are some tips for …

- January 4, 2022

- by Michael

Reasons to Get Health Insurance in Your 20s

When you're young and healthy, you might not be too worried about getting sick. But you have to understand that your health is nothing to take for granted. Medical emergencies and illnesses can hit anyone …

- December 8, 2021

- by Michael

Is Investing in Index Funds a Good Idea?

While index funds are typically considered an ideal avenue for IRA / 401(k) portfolios, even investing guru Warren Buffet has stated that index funds are the best way for ordinary investors to grow their wealth.

- November 30, 2021

- by Michael

What Are Points on a Mortgage Loan

The interest rate on a loan is the primary factor determining your payment and how much you pay the lender over the life of the loan. Did you know that in some cases you can …

- October 29, 2021

- by Michael

Why Cash Is Not as Safe as You Think

Cash has a strange dark side. It silently loses value year by year. While most people think cash is super safe, holding it long term is much riskier than people realize.

- October 23, 2021

- by Michael

Understanding Roth IRAs: The Complete Guide

Roth IRAs are a type of retirement account that offer valuable tax benefits - namely tax-free withdrawals and tax-free growth. Having a Roth account provides a lot of flexibility during retirement so you can reduce …

- September 22, 2021

- by Michael

How to Reduce Your Taxable Income / AGI

Paying taxes sucks. What you might not know is that you can lower your taxable income so you end up paying much less in taxes. Even if it is late in the year, there are …

- September 14, 2021

- by Michael

Robo Advisors - The Future or a Flop?

Robo-advisors are a new technology powered way to handle wealth management. They often consolidate all of your investment management, tax harvesting, and retirement planning requirements in the most efficient way possible.

- September 6, 2021

- by Michael

How Will Bonds Do if Interest Rates Rise?

With interest rates currently low you may be wondering how your bond fund will do if rates rise. In this post we explore a few scenarios of how it might play out.

- August 11, 2021

- by Michael

Wall Street Bets and Speculation vs Investing

You won’t know what the heck is going on if you try to read WSB like a normal person. Here is a glossary of terms to help you decipher the jargon in WSB.

- August 2, 2021

- by Michael

How Your Budget Compares to the Average

Most budgets are missing a key category - savings and debt reduction. Read on for how to use this fact to build out a sizable retirement.

- July 21, 2021

- by Michael

Calculating MAGI for Various Tax Credits and Deductions

Tax benefits and their phase out ranges are often based on Modified Adjusted Gross Income (MAGI). Updated for 2021. MAGI is calculated slightly differently for each program. See more below for how income is actually …

- July 9, 2021

- by Michael

Stock Market Returns by Decade

Graphs of stock and bond returns by decade from 1930 - present, based on three different asset allocations (100% stocks, 50/50 each, and 100% bonds). The returns are often widely different from the average.

- July 2, 2021

- by Michael

What Should a Car Cost per Day to Operate?

Are you paying as little as $2.50 per day, or over $10.00 per day for your car? Being attentive to how much your car costs and how those costs break down provides an opportunity to …

- June 17, 2021

- by Michael

EE Bonds and I Bonds – Worth a Look

The United States Treasury offers two lesser known types of bonds which are sold directly to consumers. They offer distinct advantages over CDs, bond funds, and premium savings accounts which we will discuss below.

- May 24, 2021

- by Michael

8 Ways Your Budget Changes When You Start a Family

When you decide to start a family you’ll discover a completely new world of expenses to handle. Baby food, diapers, child care, and purchases like car seats, strollers, cute outfits, slings, carriers, high chairs, etc.

- April 30, 2021

- by Michael

Real Estate Investing: What You Should Know

If you find real estate investments confusing or are yet to begin your investment journey, here’s a guide to help you get a head start! I was a landlord for several years, including during the …

- April 22, 2021

- by Michael

ETFs for Bitcoin and Other Cryptocurrencies

There are several ETFs available for investing in crypto currencies. See the list below and a discussion of the pros and cons of investing in cryptocurrency this way.

- April 14, 2021

- by Michael

How Alcohol Impacts Your Budget

When you think about your household budget, do you consider how much you will spend on alcohol each month? Do you think about how alcohol affects your health - both physically and mentally?

- February 20, 2021

- by Michael

Currency Brokerages 101: How to Use and What to Avoid

Currency brokerages are, in essence, wholesalers who deal with currency. As this industry is relatively new and not well-regulated yet, you need to be careful when choosing a currency broker.

- January 11, 2021

- by Michael

Are Electric and Hybrid Vehicles Worth It?

Hybrid and electric vehicles are often more expensive than their gas-exclusive counterparts. At the same time their operating cost is lower. With federal and state tax incentives in the mix it can be difficult to …

- December 28, 2020

- by Michael

What is a Target Date Fund?

A target date fund is a retirement fund that automatically reduces risk the closer you are to retirement.

- December 4, 2020

- by Michael

Is It Time to Refinance Your Mortgage

Low interest rates have led many people to wonder if it is time to refinance their mortgage. Low interest rates, as well as several other scenarios, might mean that it is a good time to …

- October 23, 2020

- by Michael

What to Do About Low Interest Rates

Record low interest rates have left people wondering what they should do and what will happen in the future. Here are are several things you can do about the current situation of low interest rates.

- October 2, 2020

- by Michael

What If Your Parents Are Not Able to Retire

Studies have shown that a third of boomers and seniors have no retirement savings. Read on to discover how to start the conversation and help get your parents to the best position possible as they …

- September 25, 2020

- by Michael

How Marriage Will Impact Your Taxes

Everyone wants to maximize their tax returns, and married couples are no exception. In fact, you might have specific goals as a couple for how you want to use your tax return to set yourselves …

- August 15, 2020

- by Michael

Ways to Limit Risk for Ordinary People

The following concepts will help you look at investment risk as well as expected return, and some basic and free ways to limit your risk.

- July 24, 2020

- by Michael

How to Budget to Free Up Your Time

Similar to a financial budget, we all have time budget (whether we know it or not). We budget our time in many ways. The financial budget and the time budget are related. As they say …

- July 15, 2020

- by Michael

Giving to Charity as a Budget Item

As you create your budget, a nice "feel good" line item is giving to charity. Many people donate when they can or when they are asked. Others have charitable donations built into their budgets and …

- June 30, 2020

- by Michael

Budget Like a Hero - 8 Do's and 2 Gotcha’s

Maximizing utility is essential to staying on budget, meeting your financial goals, and growing your net worth. Anybody can do it. Here are nine tips you can use to save money.

- May 4, 2020

- by Michael

How to Save Money During A Crisis

The United States, along with most of the world, is in a recession caused by the outbreak of the Coronavirus. However, there are plenty of ways to save money during the crisis. Additionally, creating good …

- April 21, 2020

- by Michael

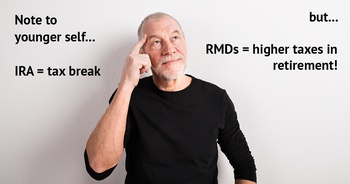

The Catch With Tax Deferred Retirement - RMDs

If you want to minimize your tax burden in retirement you need to know about the dreaded RMDs (required minimum distributions). Starting at age 72 RMDs begin to siphon off whatever you have saved in …

- April 3, 2020

- by Michael

Is It Better to Pay Off Your Mortgage or Invest?

It is important to strike a balance between paying off debt and investing. However, it can be difficult to discern what the best option is. In this post I will discuss the tradeoffs between paying …

- March 23, 2020

- by Michael

Being a Lawyer vs Being an Electrician: Net Worth Simulations

Here's what you can learn about electricians, lawyers (and other career paths) by running some comparisons with the Wealth Meta Income and Spending Simulator.

- January 30, 2020

- by Michael

The Cost to Raise a Child - 3 Scenarios

Children are expensive! My estimates range from $42,650 to $916,600 depending on lifestyle. And that is just to get them to age 18. More importantly 40-60% of the cost comes in the first five years! …

- November 30, 2019

- by Michael

How to Create A Budget

A budget is a plan for allocating your financial resources. For some it is about managing month to month, for others it is a roadmap to build the life of their dreams. A budget allows …

- October 7, 2019

- by Michael

How My Wife and I Were Able to Start Maxing out Our Retirement

Here’s how my wife and I got to a place where we could max out our annual retirement contributions. By doing so we gave ourselves a nice raise in the form of a tax cut.

- September 17, 2019

- by Michael

Is it a Hobby or a Business - Tax Implications and Perks

Do you have a hobby that creates a bit of cash flow? In this post we explore the gray area between a hobby and business and the tax considerations both situations.

- August 21, 2019

- by Michael

The Inverted Yield Curve and How Well It Predicts a Recession

A description of yield curves, what it means when they invert, and a table of historical yield curve inversions with associated market tops and recessions.

- July 23, 2019

- by Michael

How to Drop the Financial Baggage Your Parents Gave You

Your parents may have taught you how to ride a bike or drive a car but did they teach you how to properly manage your finances? Many parents are guilty of loading up their kids …

- July 11, 2019

- by Michael

How Much to Save for College?

Our approach is a) college savings is a monthly budget item, b) our kids will be aware of two cost savings routes that make a degree 25% cheaper.

- June 28, 2019

- by Michael

Is Lump Sum Versus Dollar Cost Averaging Better?

Let’s say you have $12,000 cash to invest in the markets. What is the best way to deploy that money - all at once or spread out over time? It depends on your risk tolerance. …

- June 5, 2019

- by Michael

Home Improvements That Give a Return on Investment

If you want to add value to your property, here are a few renovations that will help you increase your bottom line, both for resale value and when staying put.

- April 5, 2019

- by Michael

Will Social Security Run Out of Money? Graphs and Stats Here

Many Americans are doubtful of ever getting their Social Security benefits. They have good reason to be worried. The system is already running a deficit and is on schedule to be depleted in 2034. We …

- March 19, 2019

- by Michael

Are Flexible Spending Accounts Killing Your Retirement Benefits?

Flexible spending accounts give you a tax break in the short term but come with some drawbacks, including the fact that they reduce your social security benefits. We ran the numbers and went in depth …

- February 23, 2019

- by Michael

Climbing the Economic Ladder and Why It Gets Easier as You Go

The myth is true - the more wealth a person has the easier it is for them to get even more. This post breaks down the reasons why and shows you how to get a …

- February 13, 2019

- by Michael

Understanding Total Cost of Ownership - Ignore and Pay the Price

The other day a light bulb in my office burned out. Even though LEDs bulbs were more expensive up front I analyzed the available options and ended up saving $192.06 over 5 years!

- December 31, 2018

- by Michael

Give Yourself a Raise by Deferring Your Income

One on the neatest things you can do for yourself financially is to give yourself a raise courtesy of the IRS. Contributing to a tax deferred retirement account is a special form of saving money …

- December 15, 2018

- by Michael

How to See Through an Investment Sales Pitch

A friendly voice offers to sell you an investment that will make you rich, smart and good looking. It doesn’t matter what it is - an annuity, a mutual fund, a stock, some sort of …

- November 29, 2018

- by Michael

The Rent Spiral - Why Rent Goes Up So Much

Rents always seem to be going up. Why can’t rents stay the same? This painful phenomenon has a name - the rent spiral. If you are renting you are riding it. Let’s explore the reasons …

- October 16, 2018

- by Michael

Asset Allocation Categories - What You Can Bet On

This post explains the investment categories that are commonly found in funds and prospectuses. These asset classes come with complex risk/benefit calculations and can be used to tailor a portfolio to the nth degree.

- September 25, 2018

- by Michael

8 Ways to Win at Budgeting - Like A Boss

Ever wonder where all the money goes, live paycheck to paycheck or find yourself running low on cash? Here are some ideas for getting your finances where you want them.

- September 18, 2018

- by Michael

Rural vs Urban Living - Budgets and Net Worth

Thinking of moving someplace far away? Here are the differences between rural and urban living in terms of budget, housing, net worth and lifestyle.

- September 10, 2018

- by Michael

The Best Timing for a Remodel May Be Opposite What You Think

Let’s test the theory that waiting for a recession is the best time to pay for that $60k kitchen remodel. Sure the price will be cheaper but what about losing out on gains that come …

- August 20, 2018

- by Michael

Does Putting Money Down on a House Make Sense?

It seems like good financial sense to put at least 20% down when you buy a house… right? That is what many banks require to get a loan. But is that a good thing for …

- July 6, 2018

- by Michael

What a Legal Expert Has to Say About Popular Scams and Con Games

When it comes to money, if it seems unusual or too good to be true, it means you are being targeted by a scammer. This post explains a few scams relying on financial ignorance that …

- June 24, 2018

- by Michael

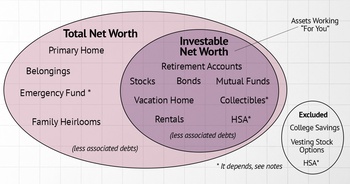

What Is Special About Net Worth and Why Winners Track Theirs

Net worth isn’t just for rich people to “keep score” in an endless game of getting more. It is a key indicator of everyone’s financial health. Income, job title, and especially what car a person …

- June 14, 2018

- by Michael

What Is Asset Allocation?

Knowing your asset allocation is essential to being a successful investor. It tells what percentage of your overall portfolio is in stocks, bonds, and other investment vehicles like real estate, precious metals, etc.

- April 30, 2018

- by Michael

Everything You Need To Know To Retire At 30 - FIRE

Retiring at age 65 sounds nice—but doesn’t retirement at age 30 sound even better? That’s the idea behind FIRE, which stands for Financial Independence Retire Early. The concepts that go into it will help you …

- April 14, 2018

- by Michael

Net Worth Defined With Precision

Net worth, the yard stick for comparing financial success is a loosely defined term (irritatingly so to our brains). See our diagram for the break down of "total" vs "investable" net worth. After you read …

- March 30, 2018

- by Michael

Five Ways to Protect Yourself from Identity Theft

Identity thieves are out to steal your personal information so they can borrow in your name, access your benefits, or drain your accounts before you notice. There are a few simple steps you can take …

- March 8, 2018

- by Michael

The Idea of Utility and Why It Matters for Budgeting

Utility is the overall usefulness you get from something. Everyone instinctively makes decisions based on utility all the time, but do you consider it when you make a big purchase or setup a budget?

- February 19, 2018

- by Michael

Twelve Reasons I Sleep Well at Night While Investing

When I was in my early 20’s I was adverse to the idea of putting money into retirement accounts. I knew on a basic level that my money was “safe” at my credit union and …

- February 7, 2018

- by Michael

Is It Better to Be Hourly or Salary?

In terms of raw take home pay, hourly can be much better compared to a salaried job with long hours. Salaried people should know their equivalent hourly wage especially when working more than 40 hours …

- January 9, 2018

- by Michael

Understanding Net Worth

Net worth is a way of measuring your progress towards financial goals. It is calculated by adding up the net market value of your assets and subtracting all your debts. If you want to build …

- October 17, 2017

- by Michael

TD Ameritrade Commission Free ETF Shake Up

TD Ameritrade has decided to change out its entire commission free ETF lineup. They are dropping almost all the Vanguard and iShares ETFs. The list used to have 100 commission free ETFs and now it …

- September 18, 2017

- by Michael

Overdraft Protection - What Banks and Thieves Love

If a thief gets into your checking account, they can drain your checking account plus your savings account if overdraft is turned on. Overdraft may not be worth the risk if you have even a …

- August 9, 2017

- by Michael

Don't Plan Your Retirement Saving, Automate It

The best day in my financial life was the day I started automating my retirement contributions. I recall a lot of stress in past years centered around market conditions, getting the ‘best deal’, and second …

- May 23, 2017

- by Michael

Inflation - Why Prices Usually Go Up

Have you ever noticed that prices are slowly rising all the time? That effect is called inflation. We’ll discuss where it comes from and how to make it work in your favor, or at least …