Climbing the Economic Ladder and Why It Gets Easier as You Go

- February 23, 2019

- by Michael

The myth is true - the more wealth a person has the easier it is for them to get even more. This post breaks down the reasons why and shows you how to get a budget tailwind easier than you thought.

The Main Reasons It Gets Easier to Save Additional Money as Money Accumulates:

- Additional wealth means extra choices in life, including the ability to say no more often.

- Having a decent sized emergency fund acts as a shield against random setbacks.

- Savings can be put to work (invested) so it grows on its own with no additional effort.

- Accessing retirement savings plans provide significant tax savings, and contributions grow tax free.

So What Is Stopping Everyone from Doing This?

The “haves” and “have nots” in society are separated into rungs on an invisible economic ladder. Each rung either keeps people down, or once climbed provides a tailwind. It shows up in little things like light bulbs and big things like saving for retirement. Sometimes the reasons people stay down are due to low income and life circumstances. Other times it is due to a person’s chosen lifestyle relative to their income.

If lifestyle drives spending, moving up the ladder and enjoying the tailwind will be hard. The higher income you have the more credit you can get. It is natural, and widely encouraged to max out your budget with fancy car leases, lavish vacations, expensive toys, over the top TV packages, new phones every year, etc. It costs money to live right? Life should be fully enjoyed! However, if your credit is maxed out, there is a hidden risk going on than can knock you down hard. If/when bad luck hits home (like losing a job) it all has to unwind. Home foreclosures and auto repossession are indiscriminate of zip code, brand name, and outward appearances.

If, on the other hand, lifestyle drives savings and “paying yourself first” is your style then it will be easier to move up the ladder. It also helps to have good credit, be financially literate, and to invest in yourself first so your future income is assured.

There are multiple rungs on the ladder to climb when it comes to building wealth easily. The differences show up when people are forced into a short term solution that is inferior compared to the medium to long term horizon (more expensive, riskier, time consuming). Here are some levels to think about:

- Poverty line and below: People at the poverty line are forced to spend on immediate needs and don’t have the luxury of saving. They often pay more for basic things. They may have higher energy bills due to old uninsulated housing, pay higher interest on loans due to lack of income or credit, and get drained by bank fees because their account doesn’t meet minimum balance requirements. Their time also gets eaten up by things wealthier people completely side step - going to the laundromat, going to the bank to cash a check, waiting for the bus, etc.

- Average Households: The average household income is approximately $55k. With that amount people can do pretty well if they are disciplined with their budget. In fact a person with an average income can become a millionaire in 30 years (and a multi millionaire in 40). They may be able to tap into work retirement plans, save up an emergency fund, build credit, buy a home (which is a form of forced savings), pay down debt, and invest a little.

- Upper Middle Class Households: Families making $120k and up can save quite a bit, provided they live below their means. At this level it is possible to max out retirement plan contributions, access work benefits like flexible spending accounts, dabble in investments, and become debt free in a short time. Their homes are likely more energy efficient and their cars are safer and more reliable (which reduces risk). They can also afford to pay for services which free up their time - which they can direct into leisure, self improvement, or income generating activities.

- The Ultra Rich: At some large number with many digits in it, people become set for life and then some. They have access to investment vehicles ordinary people do not. They can afford expensive lawyers and CPAs who work to reduce their taxes to nearly zero. They may even be able to influence lawmakers to help them improve their bottom line. This case is outside the realm of budgeting and saving for a typical household, so I won’t say more about it.

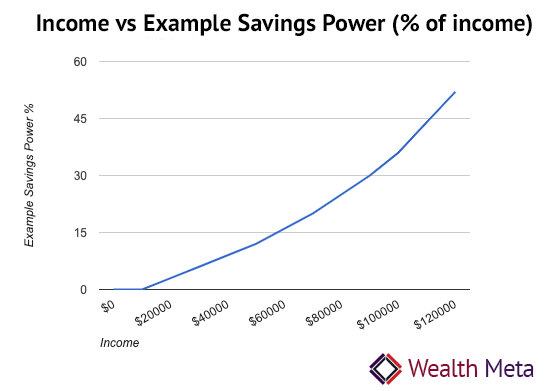

Here is a chart to give you a general idea of what percentage of household income can be saved across income levels while living modestly. That the idea that finances get easier as income increases relies on keeping slack in your budget.

Here are a couple examples that illustrate how it gets easier to save as income increases.

Payday Loans Are Evil but the Least Fortunate Do Need Them to Get by Sometimes:

Consider why payday loans exist (a $40B industry)… Life is pretty random and emergencies do happen (broken foot, car breaks down, snow storm hits and work closes, illness). If you are broke and your rent is due tomorrow, but your paycheck won’t come for a week, you can get a payday loan at some insanely high rate, say 500%. With the payday loan you can cover rent (whew), but your paycheck will be reduced by the interest and fees from the payday loan company. So life knocks you down economically.

A person with an emergency fund would never need to take this hit. Avoiding this scenario has to do with budgeting and having an emergency fund, but a prerequisite is having a high enough income to get to that point.

Taking Advantage of Work Retirement Plans:

Saving for retirement is the opposite scenario, where doing it gives you a tailwind in most cases. Employer sponsored retirement plans typically provide a matching contribution and a tax deduction in one swoop. Budgeting does matter here. If you have slack in your budget, then you can access the retirement plan. Taking that route gives you the employer paid “bonus” (typically 3-6%) and the tax deduction (let’s say 33% of whatever you contribute). Those two combine for a nice uptick in savings and wealth building courtesy of the slack in your budget.

Example 1:

A person making $50k per year who puts away 3% of their income with a work retirement plan that offers a 100% employer match on up to 6% of their salary would work like so:

- Employee contributes $1500 of their own money.

- Employer kicks in $1500 (the match, which is under the $3000 cap).

- Employee saves about $500 in taxes (at a 33% tax rate).

- Net result is $3000 going into their retirement account, and only $1000 less per year to spend (after taxes).

If their goal was to save $3000 per year, they can do that with this strategy by only giving up $1000 a year out of their budget!

Example 2:

For a person making $120k per year in a 40% tax bracket, if they max out their contribution it would look like this:

- Employee contributes $19k of their own money (the 2019 limit for a 401(k) is $19k).

- Employer kicks $7,200 (6% of their salary, which is the maximum the plan allows).

- Employee would save about $7,600 in taxes (at a 40% tax rate).

- Net result is $26,200 goes into their retirement account, with only $11,400 less to spend (after taxes).

There are not too many deals in life where you can put $1 and get an immediate 230% return! Taking advantage of that year of after year really starts to add up. Fore details of the inner workings of this move, see my post on giving yourself a raise by deferring your income.

The World Punishes People Without Access to Capital:

This post really got me thinking about the many ways poor people get screwed every day because they are steered by short term priorities.

- Ability to build credit so they can access loans with halfway decent terms.

- Have enough money in their checking / savings accounts to avoid monthly fees (typically about $1000 at most, depends on how evil the bank or credit union is).

- Many taxes are ‘poor taxes’ in they are the same no matter how much you earn. For people who are poor the percentage of disposable income the tax incurs is steep. Examples are gas taxes, cigarette taxes, local flat taxes. Social security taxes phase out over $132,900 (2019), making the effective rate diminish for every dollar earned over that amount.

- Credit Card rewards programs can be looked at as a subsidy paid by the poor who deal in cash only. Everytime I buy something in the store I’m getting at least 1% back, sometimes more depending on whatever promo they have going that month for grocery stores, home improvement, etc. I get that deal due to my good credit standing. That 1% doesn’t come out of nowhere. The retailer pays a transaction fee to the credit card company, part of which goes to cover the rewards program. That fee is theoretically reflected in the price of the product. When you use cash you pay the same price but don’t get the rewards points.

- Energy efficient appliances have similar trade offs. They cost more up front but save on utility bills in the long run, practically paying for themselves.

- Access to health care (preventive care vs going in when things are really bad).

- Access to quality transportation (wear yourself out and eat up time everyday walking or busing vs riding in your own car), or take the risk of driving a smaller older vehicle that isn’t as safe as newer bigger vehicle.

- Access to healthy foods vs sugary/fatty foods that lead to health problems.

- Access to lawyers (or complete lack thereof).

- The list can go on… I’m sure I’ve missed many things here, but you get the idea.