Net Worth Defined With Precision

- April 14, 2018

- by Michael

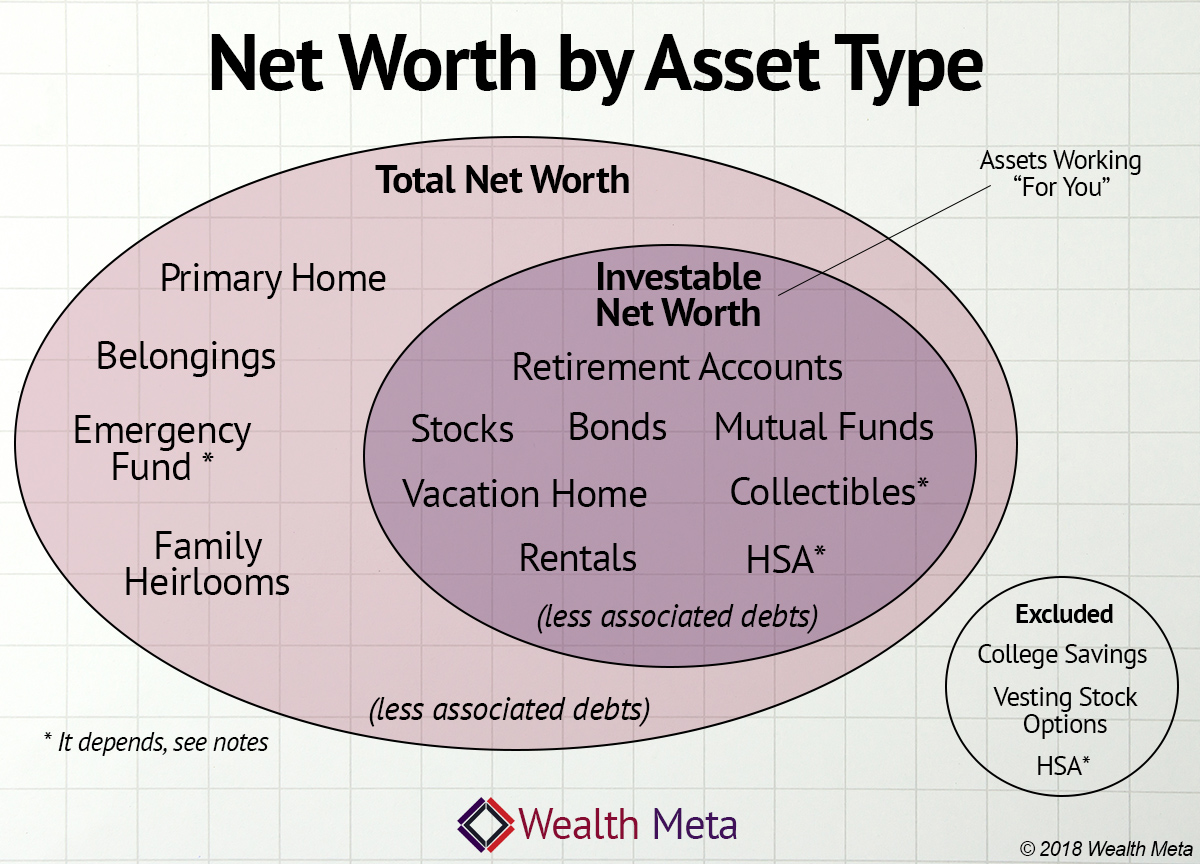

Net worth, the yard stick for comparing financial success is a loosely defined term (irritatingly so to our brains). See our diagram for the break down of "total" vs "investable" net worth. After you read this you'll be able to cut through the TV / magazine / cocktail party net worth jibber jabber and use the term correctly. When it comes up in conversation and it is used incorrectly (which is most of the time) at least it is still a useful indicator of people who don't know what they are talking about... :)

First there is your Total Net Worth: everything you own, minus debts.

Total net worth is the ultimate way to “keep score” in a capitalistic society.

If you died tomorrow and your Will said all the money would to your kids, they would inherit your total net worth. This is all your retirement accounts, home equity, belongings, cash box in the attic, etc.

Total Net Worth is the ultimate objective measure of financial success. It is a number you need to understand about yourself in order to make smart investment decisions.

Within total net worth there are four main categories:

- Your emergency fund

- Your personal belongings (your car, your baseball card collection, furniture)

- Your home

- Your investments (stocks, bonds, mutual funds, retirement accounts, rental properties)

Which brings us to where all the action is with net worth: Investable Net Worth

Investable Net Worth is a subset of your total net worth. It only counts the money you’ve setup to grow and work for you while you go about your life. Another way of defining it is your overall investment portfolio.

Investable Net Worth is typically made up of things like mutual funds, etfs, stocks. It is stored in a variety of places, retirement accounts (401(k), Roth IRA, etc), banks, pension funds, etc.

For the purposes of saving for retirement, when we talk about net worth, it is your investable net worth that matters. There are things in your total net worth, like family heirlooms, or even your primary home that you can’t sell a small fraction of to pay for living expenses. So, your house and your great grandma’s ring go in total net worth, but not in investable net worth.

Some things are not as clear cut, like your emergency fund, HSA account, or your vacation home. It is up to you how to categorize those assets.

Here’s a list of assets and how we classify them:

|

Asset Type |

Total Net Worth |

Investable Net Worth |

|

Stocks |

Yes |

Yes |

|

Bonds |

Yes |

Yes |

|

Mutual Funds |

Yes |

Yes |

|

Retirement Accounts |

Yes |

Yes |

|

Emergency Fund |

Yes |

? - There are a few ways of looking at this. Some people keep a cash account for emergencies and exclude it from their investment portfolio. Others keep a cash position in their portfolio for this purpose. Still others count assets they can easily sell off tax free (for example a Roth IRA account), but pad the available balance mentally in case the market melts down(-40%). This latter idea is likely not FDIC protected and the most risky. |

|

Primary Home |

Yes |

No Except…. if you have it paid off this is a huge cushion in retirement as you could downsize at some point. So maybe put the % you plan to downsize into a ‘real estate category’ to reflect that allocation. |

|

Personal Belongings |

Yes |

No |

|

Vacation Home |

Yes |

Yes A vacation home acts as an investment for tax purposes. People with vacation homes may not realize just how big a chunk of their money is invested in real estate in terms of overall asset allocation. |

|

Rare Art Collection |

Yes |

? - It depends... Do you view it as an investment you’d sell for the “right price” or as a personal belonging you couldn’t bear part with? |

|

Family Heirlooms |

Yes |

No - unless you are planning to sell them |

|

Vesting Stock Options |

No If you can’t sell it, it’s not worth the paper it’s printed on, at least right now. |

No |

|

Your Business |

??? Valuing a business is complicated to say the least. For starters there is liquidation value, cash flow valuation, gross revenue valuation. |

No |

|

College Savings Accounts |

No - this is a gift |

No |

|

Health Savings Account |

? - It depends…

|

No, if you are planning to spend most of your balance on medical expenses or it is in a cash like account (not invested, just there for emergencies), consider this already spent. Yes, if you invest the balance and hope to to withdraw against it like a retirement account after age 65. |

|

Asset Type |

Total Net Worth |

Investable Net Worth |