Why Cash Is Not as Safe as You Think

- October 29, 2021

- by Michael

Cash has a strange dark side. It silently loses value year by year.

While most people think cash is super safe, holding it long term is much riskier than people realize. It does not matter if your cash is in a savings account, a certificate of deposit, or under your mattress.

The safety of cash all depends on your timeline. Let me be clear - cash is a safe store of value in the short term, but in the long term not so much.

Here is a rule of thumb: cash is for budgeting but not long term investing.

The face value of cash isn't what matters per se. What really matters is the purchasing power - what that cash can get you. Purchasing power is how well a given face value of money translates into tangibles such as food, housing, warmth, enjoyment, etc. If $50 buys a bushel of bananas today, but in 10 years, that same bushel of bananas goes for $55, that is 10% inflation. After 10 years, the amount of bananas that $50 translates into is less than it was before. Of course it also depends on supply and demand for bananas, which may cause the price to fluctuate independently of inflation.

Inflation causes an overall loss in purchasing power - across all product categories regardless of supply and demand. This is a very real phenomenon that eats away at people's savings.

For more on how inflation works, see our post on “why prices go up”. The short explanation is the US money supply is being diluted by the Federal Reserve on purpose, which drives inflation. Federal budget deficits (which are now the norm) and the massive stimulus bills of 2020 and 2021 contribute to the effect. After prices, the last thing to go up are worker's wages - as workers demand a nominal pay increase so they can retain their standard of living. The cycle goes on and on...

The perverse thing is the Federal Reserve quotes official inflation at what feels way below what the everyday American pays for things. In particular housing, education, healthcare have all gone up at a rate WAY beyond the CPI (consumer price index). There is a lot of argument over what actual inflation is and how it is calculated. Unfortunately the government has an incentive to keep the CPI numbers low so they can effectively tax everybody in this hidden way.

What about interest?

Even if your cash is earning interest in the bank, it is likely still below the inflation rate. Holding your money in an interest bearing account is smart and will stave off some of the erosion in purchasing power. Consider that most savings accounts today have a negative 'real' return.

The real return is the rate you are getting minus inflation. If you are getting 3% but inflation is 4%, you are getting a -1% real return. The real return is what you care about because that translates back into bananas (or whatever you are buying in 10 years).

The rate of return you can get in a savings account, or even a high yield savings account, is essentially risk free. The reason it is risk free is because it is FDIC / NCUA insured and backed by the federal government. Ever hear the expression no risk, no reward? Well with a savings account there is no risk, and the reward merely reduces the effect of inflation or cancels it out at best. There have been periods in history where savings accounts offered positive real returns but those returns were pretty small, and below that of returns offered by bonds (which carry more risk).

Here is the proof:

Our Retirement Withdrawal Calculator calculator uses backtesting to calculate how different investment choices work out in retirement.

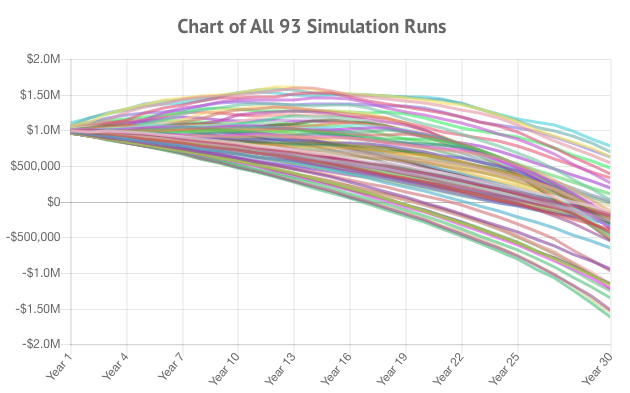

Consider a person who saves $1,000,000, keeps it 100% in cash, makes an annual 4% withdrawal, and does this for 30 years. Here is how their portfolio did using our simulator:

100% cash - 0% stocks, 0% bonds - result = 14% chance of having money left over, average ending balance = -$334k (went broke before kicking the bucket)

Notice how a portfolio that is all cash essentially looks like a comb over and goes straight into the ground.

The solution to a cash only portfolio:

If you are looking at a long term holding period, based on the charts above cash really isn't a safe option. But what is? Turns out there is a LOT of discussion about this online but what our calculators show is holding a blend of stocks and bonds will oftentimes do really well.

Even a small percentage of stocks, say 30% ends up doing way better than a cash only portfolio.

Your ratio between stocks, bonds, and cash is a personal decision. It is called your asset allocation. To decide your asset allocation consider your investment time horizon, your risk tolerance, and your goals. Some people go for 100% stocks and sleep just fine. Others are more conservative and hold a large percentage of bonds. Some can’t decide and go with a 50/50 split. Others adjust the percentage of bonds periodically based on their age to "lock in" gains. There are dozens of strategies, but I've never seen a retirement strategy based on cash only.

Here are some example returns using basic asset allocations. Note how the results are pretty incredible compared to the cash only portfolios above.

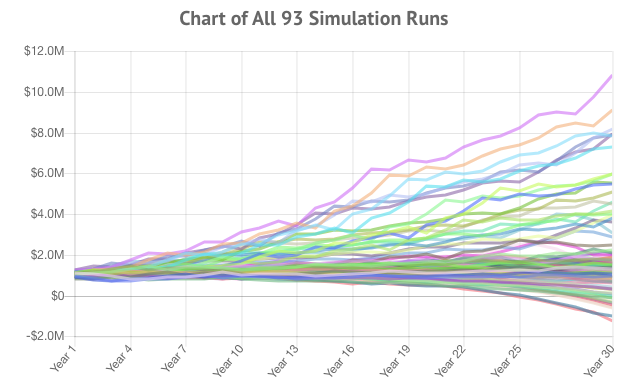

30% stocks, 70% bonds - 89% success rate, average ending balance $2.1M:

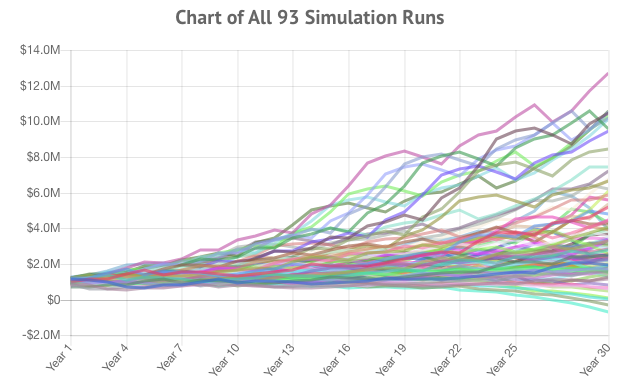

50% stocks, 50% bonds - 98% success rate, average ending balance $3.6M:

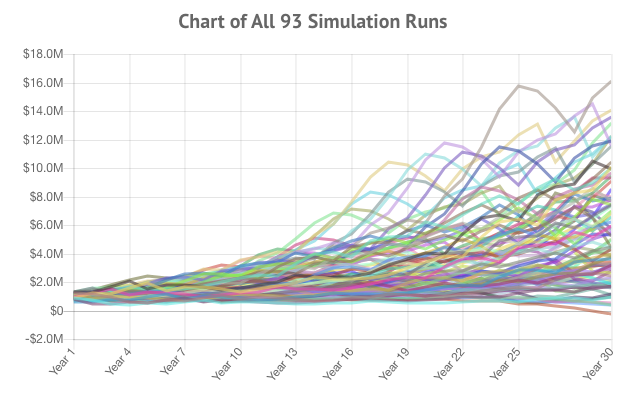

70% stocks, 30% bonds - 99% success rate, average ending balance $5.5M:

These chats may look like an argument to invest more in stocks. It is true that stocks offer a higher return (based on past returns), but they also carry more risk. Consider the effect on a person’s retirement if stocks were to crater -50% the year after a person retires. Bonds are used in a portfolio to offset some of that risk and balance out times of volatility.

For more reading:

- These graphs were generated by our Retirement Withdrawal Calculator. If interested in digging more into the numbers our Portfolio Allocation Calculator will let you explore cash returns decade by decade and compare against inflation.

- Inflation Calculator

- Saving for Retirement Calculator

- Retirement Withdrawal Calculator

- Inflation - Why Prices Go Up

- The Real Retirement Killer - Inflation

- The 8th Wonder of the World - Compounding