Home Values and Rising Mortgage Rates

- October 18, 2022

- by Michael

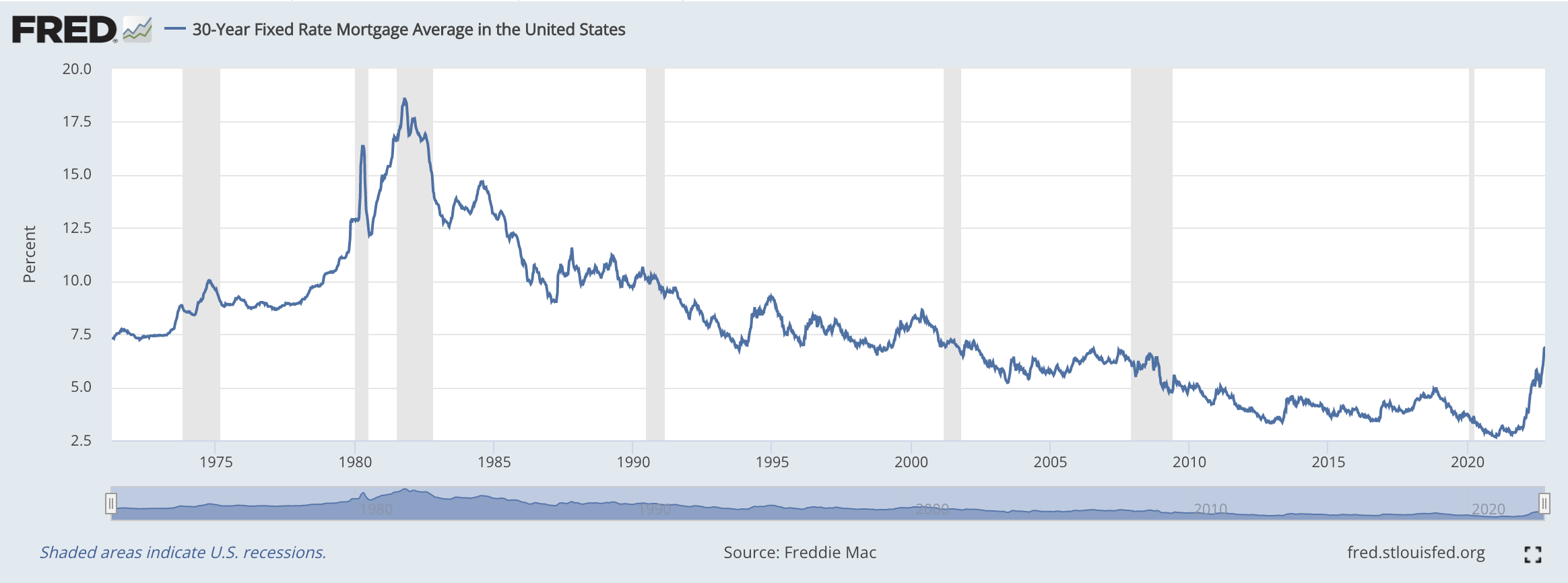

Mortgage rates have gone up over 4% between October 2021 and October 2022. Although nowhere near the peak of 18% in 1981, rates have not been higher since 2002. The housing market is about to go through a major transition as the equilibrium between buyers, sellers, and lenders is restored.

Why do mortgage rates change housing affordability?

When you buy a house, the interest rate you get on the mortgage is one of the main drivers of the price and your payment.

Your income and existing debt will determine what your maximum mortgage payment can be. Typically this is something like 28% of your gross income, with all debt including your mortgage being no more than 36%.

Given a certain monthly payment, the higher the interest rate, the less you can borrow (because more is going towards interest).

Where are we at with interest rates today (10/2022)?

Mortgage rates are rising sharply. They have not been this high in 20 years. Compared to the 1980’s 7% still looks like a great deal.

For the latest chart see the St. Louis Fed page.

An example of how a change in interest rates impacts home affordability:

Let’s say you make $150,000 per year, have great credit, and carry no debt. 28% of your income works out to $42,000, or $3,500 per month. Buying a house at the top of your budget is another conversation, but for the sake of argument let’s say $3,500 is something you are happy with paying and want to shop for the best house you can get.

Now that $3,500 per month translates into very different purchase prices when rates are 3% (October 2021) vs 7% (October 2022).

In the 3% scenario you could borrow $760,000 but in the 7% scenario you could borrow just $482,000.

In both scenarios we consider 30 year fixed loans, with $3,000 per year for real estate taxes, and $500 for homeowners insurance.

Mortgage at 3%:

|

Interest Rate |

3.00% |

|

Amount Borrowed |

$760,000 |

|

Total Payment |

$3,495.86 |

|

Principal + Interest |

$3,204.19 |

|

Principal |

$1,304.19 |

|

Interest |

$1,900.00 |

|

Real Estate Tax |

$250.00 |

|

Homeowner's Insurance |

$41.67 |

Mortgage at 7%:

|

Interest Rate |

7.00% |

|

Amount Borrowed |

$482,000 |

|

Total Payment |

$3,498.42 |

|

Principal + Interest |

$3,206.76 |

|

Principal |

$395.09 |

|

Interest |

$2,811.67 |

|

Real Estate Tax |

$250.00 |

|

Homeowner's Insurance |

$41.67 |

So where did the $287,000 in home value go???

The answer is, it simply vanished into thin air. Who knows if it was even “real” to begin with…

One way to think about it is, the value was eaten by the extra $911.67 in interest that is due each month.

Another way to look at it is, home values in the 3% scenario were being propped up by low rates. Meanwhile home values in the 7% scenario are being pushed down due to higher borrowing costs.

The only silver lining is, at 7% you can afford less so you need less of a down payment!

Why do mortgage rates impact home prices?

Essentially, the lower the interest rate the “more house” can afford based on the monthly payment you qualify for. When rates go up that means you can afford less home on the same income. This happens to EVERYBODY at the same time though, and this creates some interesting side effects.

When interest rates drop, more people can afford homes which increases demand and eventually causes prices to rise until the market is back in equilibrium. Conversely, when rates rise, many buyers are priced out of the market, which means home prices naturally want to fall. When there are not enough people filing for mortgage loans, this also puts downward pressure on interest rates (which would in theory cause home prices to rise). So there are several different points of tension between home buyers, home sellers, and lenders. We did not mention home builders, land lords, nor investment companies. Their activities factor into the market as well much in the same way.

The main reason mortgage rates have increased in the past year is because the Fed raised their base rate aggressively to try and combat inflation. If this manages to create a slowdown in the housing market this may cause housing prices to decrease which would be part of their goal. The problem is it hurts people who are shopping for a home, or who just recently purchased a home since they may find themselves underwater.

Is it still possible to buy a house regardless of the high interest rates?

As impossible as it sounds, it is doable if you follow certain steps:

- Wait for prices to drop and make a larger down payment - the more you can put down, the better your loan-to-value (LTV) ratio, which means you can get a better rate (and a lower monthly payment).

- Get a loan without PMI - saving at least 20% can lower your monthly mortgage payment and help you avoid the need for private mortgage insurance (PMI). PMI costs typically range from 0.5% to 2% of your total loan amount, and you'll typically pay PMI monthly.

- Getting a short-term mortgage - if you get a loan for 15 or 20 years, you have the possibility to get lower interest rates. Mortgage payments may be higher, but you would save on interest over time and be out of debt sooner. Another option is to opt for the 30 year loan and pay ahead on it.

- Shop and compare rates - one way to save money on your mortgage is to get quotes from multiple lenders with different interest rates. According to the Consumer Financial Protection Bureau (CFPB), you can save $300 a year on average just by getting more than one quote.

- Improve your credit score - the better your credit score the lower your rate (up to a point). If your credit could stand to have some cleanup now would be the time to do it.

Conclusion: Whether it is possible to buy a house when interest rates rise is up to you to decide.

If you want to calculate the monthly mortgage amount for the house you want to buy, you can use our PITI calculator to get the Payment + Interest + Taxes and Insurance. You can also use our full mortgage amortization calculator which looks at total interest paid.