What is a Target Date Fund?

- December 28, 2020

- by Michael

Saving for retirement can seem like a momentous task, especially if you are still young. A target date fund is one way that people can simplify their financial life. There are several options for people who want to use target date funds but you need to understand how they work.

Whether you’re exploring target date funds for yourself or simply want to know your options when it comes to retirement, there are several things everyone should know about target date funds and how to use them. Other names for target date funds are life path funds, target retirement funds, etc.

What is a Target Date Fund?

A target date fund is a retirement fund that automatically reduces risk the closer you are to retirement. The intention is this one fund will do everything for you – give you global diversification and automatically manage the risk profile of your asset allocation as you age. The idea being that you don’t end up with a large negative shock to your portfolio right before you retire. With a target date fund you never have to worry about rebalancing because the fund managers are doing it for you. That assumes you have all your retirement in this one fund and no other accounts or holdings to consider.

Typically, investors that are further from retirement can take on more risk in the hope of getting more reward. In the case of target date funds that means in general that younger workers hold a larger percentage of stocks. As a person approaches retirement, their fund will automatically recalibrate toward having lower risk (more bonds, less stocks) but a lower potential reward.

The goal of a target date fund is to build a nest egg that can grow over time first, then gradually become more protective of a person’s investments. When a person opens a target date fund, they indicate when they plan to retire. That sets the timing for the glide path from high risk to low risk (stocks to bonds).

How to Use a Target Date Fund

When you decide to use a target date fund, the first thing you need to do is choose the year you plan to retire in. Target date funds are created and named based on the year they switch over to being at their lowest risk point. Make sure to read the fund prospectus or talk to your financial advisor so you know how it works and what the final allocation of stocks to bonds is.

For example, if a person is 30 and wants to retire when they are 65, they would choose a fund that is 35 years out. If the current year is 2020 they would pick the 2055 fund.

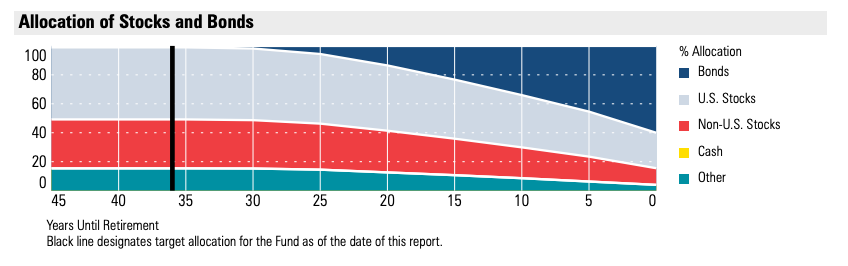

BlackRock LifePath® Index 2055 Fund:

Note that this fund is 100% invested in stocks and “other”, but does not hold any bonds yet.

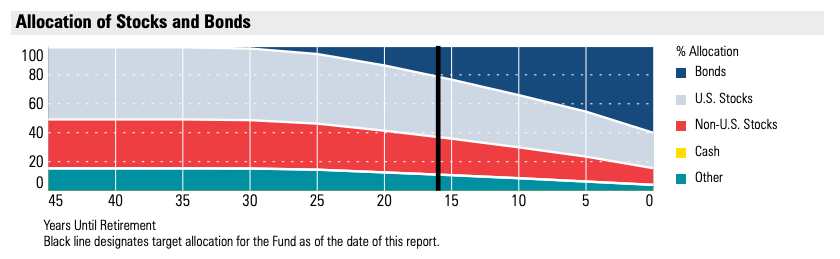

If a person is 45 and wants to retire when they are 60, they will choose a date 15 years from now (if the current year is 2020, that would be the 2035 fund).

BlackRock LifePath® Index 2035 Fund:

Note how the 2035 fund shown above is just starting to increase the bonds allocation.

Next, you’ll want to work with a financial advisor to decide how much you need to invest. Target date funds are designed to be a person’s only retirement fund, so you will want to go over the math. Your financial advisor can help you figure out if your investments will be enough to retire on or if you’ll need to make changes to your investment strategy.

Our Saving for Retirement calculator can give you more ideas.

Target Date Fund Advantages

Target date funds are popular for many reasons.

- Easy to use – Target date funds are known for their simplicity. Many people see them as a ‘set it and forget it’ means of investing because a target date fund manages the changes in your risk tolerance for you.

- Highly diversified – Target date funds are made up of a wide range of stocks and bonds to help people diversify their investments.

- Zero maintenance – Since the fund managers are dealing with rebalancing and keeping the asset allocation on track there is zero work to do on your part.

Target Date Fund Disadvantages

Target date funds are not perfect for every investor. There are a few things to watch out for when opening your target date fund, including:

- They vary between investment companies – what the fund actually invests in varies widely from fund to fund. For example, some funds stick to indexes while others do active management. Some funds prefer US stocks while others weight heavily towards international stocks. Others delve into mortgage backed securities and corporate bonds vs US treasuries to get a higher yield. This variance can change over time, so discuss it with your financial advisor before choosing a target date fund.

- They can be expensive – Target date funds are simple to use, but the fees can add up. Most are geared to be affordable, but some can charge up to 0.75% of the assets under management. Therefore, understand your fees before purchasing a target date fund and how those fees eat into your overall returns. For example Schwab makes it a little confusing they have Target Date INDEX funds which have very low expense ratios (~0.08), and they also have Target Date Funds (active management) which do a very similar thing but come with expense ratios anywhere from 4 to 9 times higher!

- There may be other options – A target date fund is a group of funds, so sometimes the funds offered in a target date fund are also offered by other products that a company manages. Therefore, you may want to explore other investment options before choosing a single fund family.

- Glide paths can vary widely – Some funds start reducing risk 15 years out but only end up with a 50/50 allocation of stocks and bonds. Others start tapering much sooner and end up with 100% in bonds at the time of retirement. Make sure you are comfortable with the way the fund manages risk.

Special Considerations

Choosing a target date fund is only one part of your retirement strategy. Therefore, it is crucial to consider your current investments when choosing a target date fund. For example, if your other investments carry a lot of risk, you may want to choose a more conservative mix in your target date fund.

Additionally, you should consider your overall asset allocation. Some investments have a higher return, so you should speak with your financial advisor about how your assets will perform collectively.

Finally, you should consider if your funds will carry you though retirement. You will not likely use all your retirement funds right away, so a portion of your retirement funds will continue to be invested. It is wise to explore your withdrawal strategy, our retirement withdrawal calculator can give you some ideas but also talk to your financial advisor.

The Takeaway

A target date fund is a simple way to invest for retirement. This self-managing fund has relatively low fees and is easy to ‘set and forget.’ However, it is essential to consider all your investing options and how your other investments will contribute to your retirement. Everyone has unique goals and investing strategies, so it is wise to speak with a financial advisor before enrolling in a target date fund.