US Treasuries for Individual Investors

- October 9, 2022

- by Michael

US Treasures are a way of directly investing in bonds backed by the US government. They come in a wide range of durations, anywhere from a few days to 30 years. They offer excellent liquidity and protection of funds "backed by the full faith and credit of the US government".

Rates are competitive vs equivalent CDs and money market funds and sometimes much better depending on market conditions and your tax situation.

Types of US Treasuries:

US Treasuries are broken up into 3 types based on their duration:

- Treasury Bills (T-Bills) - duration from a few days to 52 weeks (1 year). They do not pay interest, instead they are purchased at an amount below their face value. For example if the interest rate on a 1 Year T-bill was 5%, you'd purchase it for $95.24, and one year later get $100 back.

- Treasury Notes (T-Notes) - duration of 2 to 10 years. Pays interest twice a year.

- Treasury Bonds (T-Bonds) - duration of 10 - 30 years. Pays interest twice a year.

What are US Treasuries Yielding?

Rates fluctuate all the time. The definitive source on current US Treasury rates is available in the form of previous auction results at the Treasury Direct website.

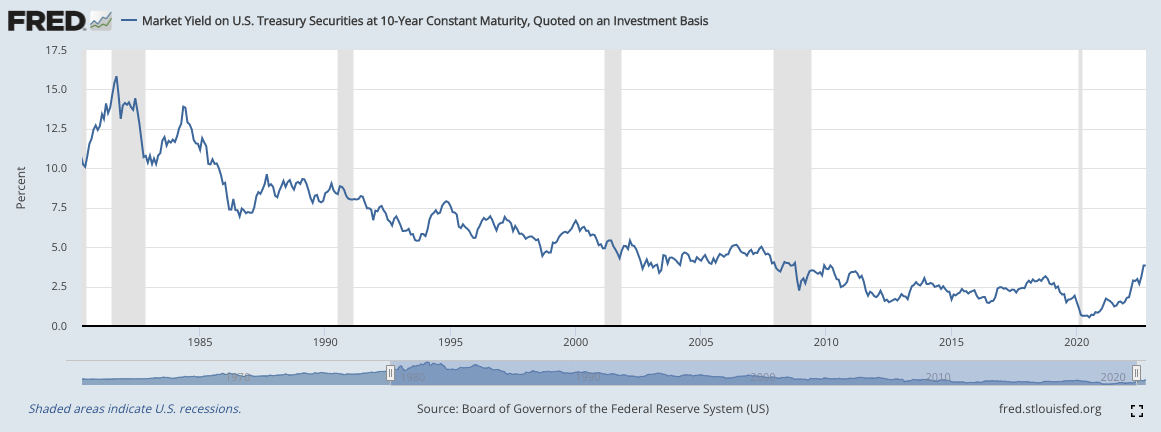

Here is a chart of the 10 year T-Note yield from 1980 to 2022. As you can see rates change frequently but are currently on the rise.

How to buy US Treasuries:

The easiest way to buy US Treasuries is through your online broker, such as Vanguard, Fidelity, etc. Most offer an easy to use interface, and commission free trading. These brokerages also make it easy to sell your US Treasury early if you don't want to wait for it to mature. When the bond matures the cash will be automatically put back into your settlement account. Some brokerages offer a way to auto renew treasuries when they mature.

Another option is to use the federal government's website Treasury Direct to buy them directly from the US government. However, there are some major drawbacks to this approach. The website is extremely clunky and out dated. Navigation is confusing. There is no 'settlement fund' within your Treasury Direct account. All buy/sell orders are transacted between your bank account and Treasury Direct, making it cumbersome to implement complex strategies. Finally, there is no access to a secondary market, so if you want to sell your bond early you have to first transfer it out. Note that when it comes to EE Bonds and I Bonds you are forced to use Treasury Direct, but this is not the case for Treasuries.

Comparison of Treasuries to CDs:

Shorter term US treasuries can operate a lot like CDs in your portfolio. They can also be included in your emergency fund. The major difference (aside from insurance which I'll address below) is how they are purchased.

With a CD, you transfer the money into a special CD account at your bank or credit union. The bank then pays interest on your balance according to the terms of the CD (monthly, every 6 months, etc). When the CDs duration is over, the money is transferred back to your checking or savings account. Breaking the CD early may involve a penalty of a few months of interest.

With a US Treasury, you can either purchase a new issue at auction (most common), or an existing issue through the secondary market. Your brokerage will make this process very easy, similar to ordering a product online. There are fixed increments you are allowed to purchase in ($100 - $1,000). With the shorter duration T-Bills, there are no interest payments since they are purchased at a discount to the face value. The T-Notes and T-Bonds pay interest twice a year. If you want to cash out early you can sell the bond on the secondary market, this is subject to interest rate risk. If interest rates rise your bond will be worth less. If interest rates drop your bond will be worth more.

For more thoughts see our blog post on bonds vs CDs.

Are Treasuries Riskier than CDs?

In general, YES, bonds are riskier than CDs or money market funds because the bond issuer could default (go bankrupt).

However, when comparing US Treasuries to CDs or money market funds, the US government is the backer in both cases. US Treasuries are the grandaddy of bonds, considered a safe haven in the financial world. There is no comparison to a US Treasury bond and a bond issued by some random corporation with lots of debt and an uncertain future.

If the US Government is unable to cover an FDIC / NCUA claim (in the case of a bank or credit union going bust), or if defaults on a US Treasury payment, there are probably much bigger issues to worry about (civil war, nuclear armageddon, world wide catastrophe, alien invasion, etc).

Personally I sleep good at night with this distinction, but it is up to you (and your financial planner) to decide if the benefits of US Treasuries out weight any extra risk because of the nature of the investment.

Special Tax Treatment:

A big plus of US Treasuries is they are exempt from state and local income taxes. So if you are in an area that is "blessed" with high state and local income taxes US Treasures could make a lot of sense. For example, if your state income tax rate is 10%, a US Treasury yielding 4% would have the same after tax yield as a CD at 4.4%.

Note that only applies to taxable accounts. If you are holding US Treasuries in a tax deferred account such as an IRA or 401(k) the tax treatment is moot.