Everything You Need To Know To Retire At 30 - FIRE

- April 30, 2018

- by Michael

Retiring at age 65 sounds nice—but doesn’t retirement at age 30 sound even better? That’s the idea behind FIRE, which stands for Financial Independence Retire Early. The concepts that go into it will help you better understand your finances - we cover them here.

A disturbing number of Americans aren’t on track to retire at all. Then there are select few who realize how FIRE works, throw themselves into it, and get to enjoy the freedom financial independence offers at a young age.

Realistically, retiring at 30 takes hard work, solid financial skills, and being in the right place at the right time. So retiring at 30 is an admirable goal and it would be amazing but it would require a large degree of luck along the lines of a nice inheritance, working for a company that has a big IPO, or having the right connections and promotions. Luck aside, by following FIRE principles, even if you miss the lofty goal of retiring at 30, you’ll still probably end up retiring at age 40 or 50 which is outstanding.

No matter when you decide to “retire” (whatever that means), following these principles will give you more options along the way. Having options is a form of wealth and success unto itself. These options include flexibility when it comes to career decisions, multiple planned sabbaticals during your career, or simply the ability spend more time with your family.

How Does FIRE Work?

The basic idea of FIRE is to save up enough money such that you can quit your job and live a life of comfort without ever needing to punch a clock again. Essentially you work a little harder now to make things way easier later.

The first key to attaining FIRE is to save and invest a large portion of your income—generally at least 50%. Getting to FIRE requires earning a good amount of money yet living well below one's means and being frugal since the priority is to save not spend.

Living frugally also helps you reach “retirement” sooner, because the lower your expenses the less money you need to have to meet your expenses indefinitely.

Aside from a high savings rate, the second key to FIRE is leveraging the power of compound interest. If you invest all of your savings your money will begin to multiply which will allow you to reach your retirement number much sooner. Having an understanding of what to invest in to get a decent rate of return (say 5%) without taking excessive risk is part of the adventure (more ideas on that below). The earlier in life you start this process the sooner you can get to FIRE since compounding is an exponential process and the impact gets larger as time passes.

Are You FIREd Up? Here’s What You Need to Understand

While achieving FIRE isn’t easy, the basic principles are simple and sound financial advice even for those who plan to continue working at least through middle age. Here are the basic tenets of FIRE:

- Eliminate debt as soon as possible.

- Save a large percentage of your income (generally over 50%).

- This is achieved by maximizing your income while living as frugally as possible to minimize expenses.

- Get compound interest on your side, starting yesterday. Taking advantage of compound interest means your investments will grow faster and you’ll be able to reach financial independence sooner.

- When making purchases maximize utility, and know when to pay for quality.

- Invest your money wisely so it works for you.

- Some thoughts on getting comfortable with the idea of investing.

- Minimize investment expenses by selecting low-fee investments.

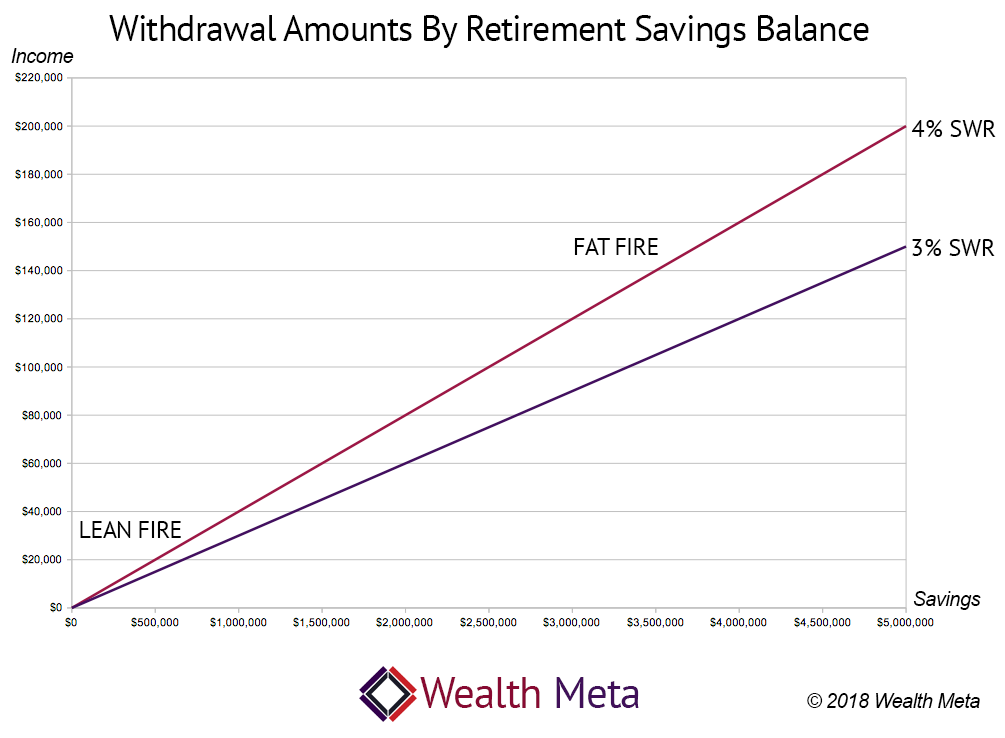

- Select a safe withdrawal rate (SWR), which is the percent you can take out of your portfolio each year for expenses, yet not risk running out of money before you die.

- Based on trinity study and our calculator based on it a typical SWR is between 3-4% of investable net worth.

- Note, the SWR does NOT count extra income from social securities, pensions, inheritances, or side hustles.

- Learn to live well below your means and be happy with it.

- The lower your expenses, the less money you’ll need saved up in order to meet your SWR. That means the sooner you can quit your job and live off your investments indefinitely.

The Language of FIRE:

There are several acronyms associated with FIRE which appear often in this popular forum on Reddit: https://www.reddit.com/r/financialindependence/

Where you live:

- LCOL - low cost of living area.

- MCOL - moderate cost of living area.

- HCOL - high cost of living area.

Your progress towards FIRE::

- CoastFI - the point where you have saved enough money that it will grow on its own to the size you need by the time you plan to retire. At CoastFI you no longer need to save a dime to hit your financial goals. It does assume your projected rate of return is accurate and you don’t experience any unanticipated hits to your portfolio.

- LeanFI - starting to withdraw a little from your nest egg, but also still earning some income.

What kind of lifestyle you want in early retirement:

- LeanFire - living frugally on less than $40k/year.

- BaristaFire - working a low wage part time job somewhere awesome (Hawaii, Sedona, Aspen), subsidized by small withdraws from your nest egg.

- FatFire - pursuit of financial independence and early retirement with the goal of an upper middle class lifestyle in retirement (as opposed to LeanFire which involves cutting expenses to the bone and “retiring” as soon as possible). You can read more about FatFire here: https://www.reddit.com/r/fatFIRE/

Depending on how much money you’ve saved and what you withdrawal rate is, you may end up in of of these three restaurants on a regular basis:

- McDonalds FI at $1M, with a 4% SWR = $40,000 per year

- Olive Garden FI at $2M, with a 4% SWR = $80,000 per year

- Ruth's Chris FI at $3M, with a 4% SWR = $120,000 per year

A Graph of How Much You Need to Achieve FIRE:

FIRE Strategies:

If you’re interested in pursuing early retirement / financial independence, the path is deceptively simple—all you need to do is decrease your expenses and increase your income. Here are some common (and relatively easy) ways to accomplish one or both of those goals:

- Move to a smaller home

- This frees up equity and reduces debt (if you have a mortgage currently).

- Smaller homes typically have lower taxes and less maintenance.

- A smaller place means less stuff to buy to fill it up.

- To reclaim some square footage build a shed in the backyard that is partially finished but exempt from taxes.

- Get a home that generates side income

- Buy a duplex or a home with an attached dwelling unit (ADU)

- Get a roommate

- Work in a HCOL area while you are young then relocate to a LCOL area in retirement to benefit from lower expenses.

- Minimize living costs with roommates / frugal strategies while in the HCOL area.

- Ask for a raise or get a better-paying job.

- Easier said than done, but if you are going after FIRE you have to put yourself first.

- Invest in your education and skills early in life (but avoid the debt trap of a college degree from a fancy school in an area with no jobs).

- Learn how to add value to a business and hone your communication skills.

- Get a side hustle (or way of making money aside from your regular job).

- Do freelance or consulting work in your area of expertise.

- Etsy / Ebay / Gig Economy - the number of potential side hustles out there is endless—and could end up earning you more than your full time job!

How Wealth Meta Helps

If you’re working towards financial independence, it is critical to track your expenses, income and savings, as well as to set goals and use models to understand how different choices can affect when you’ll reach your goal. Here are how our tools help:

Home Budget Tracker - Understanding where your money is going is the first step towards paring down your expenditures. Use the budget tracker to find opportunities to save.

Income Spending Simulator - It’s hard to understand how a $500 reduction in monthly spending will play out in 10 years—until you use our income and spending simulator. Use it to understand how your choices now affect your path towards financial independence.

Saving For Retirement Calculator - This quick calculator shows how a given asset allocation impacts your ability to reach financial independence on a specific time frame - and what you can change to get to FIRE sooner.

Retirement Withdrawal Calculator - A safe withdrawal rate is key to FIRE, and this tool uses historical data to help you figure out what a safe withdrawal rate would have been over 90 years of historical data… which you can use to make decisions about your withdrawal rate in the future.

If you’re going to work towards retirement at any age, saving and careful investing are important. The more ambitious your retirement goals, the more important it is to track progress, keep an eye on your net worth and stay motivated to make your FIRE dreams a reality.