What Are Life Path / Target Date Funds?

- August 10, 2022

- by Michael

LifePath or Target Date funds are a set it and forget it single investment solution to retirement planning. The basic idea is as you get closer to the target date, the holdings in the fund shift from risky volatile high return assets (like stocks) into low risk, stable, low return assets (like bonds). The funds are also an ‘all in one’ approach meaning they offer a lot of diversification and automatic rebalancing across asset classes.

The features of LifePath / Target Date funds are discussed further in detail below.

What Are Target Date Funds?

Target date funds are a type of investments that help investors plan for future expenses. They are available in mutual fund or ETF (Exchange Traded Funds) format. They typically have low fees and are often a choice in employer sponsored 401k plans and 529 college savings plans. Investors can use these funds to target their retirement year or their child’s future college enrollment.

Their name will include the ‘target year’ that the fund will completely switch over. For example:

- Target Retirement Fund 2045

- Target Retirement Fund 2050

- Target Retirement Fund 2055

So if a person plans to retire in 2050, they would pick the 2050 fund and ignore the others.

How Do Target Date Funds Work?

It is essential to learn about the workings of target-date funds before investing in them.

Asset appreciation is the primary goal in the early years of the fund. Capital preservation is the primary area of focus once the target year is getting close or is reached (depending on the prospectus).

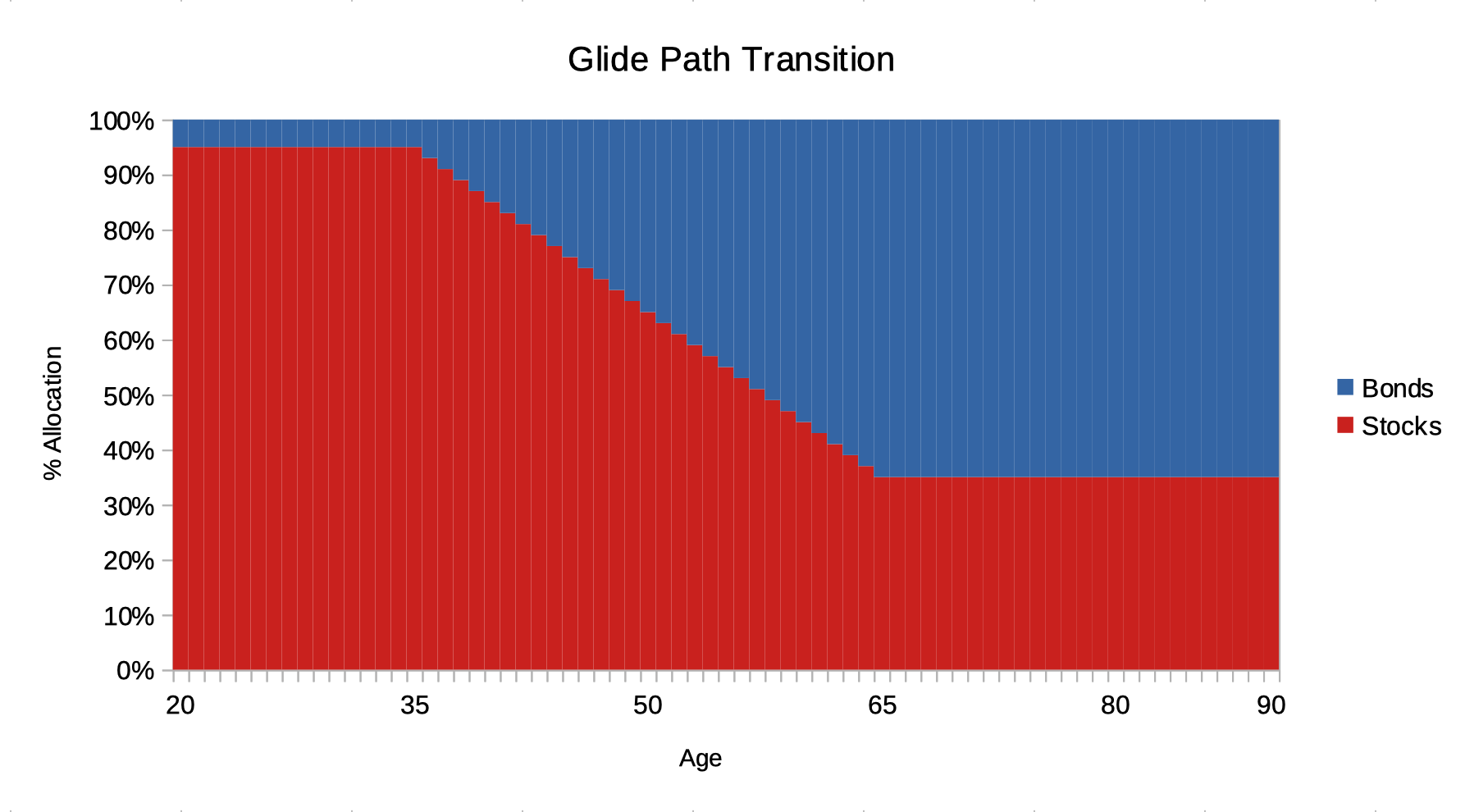

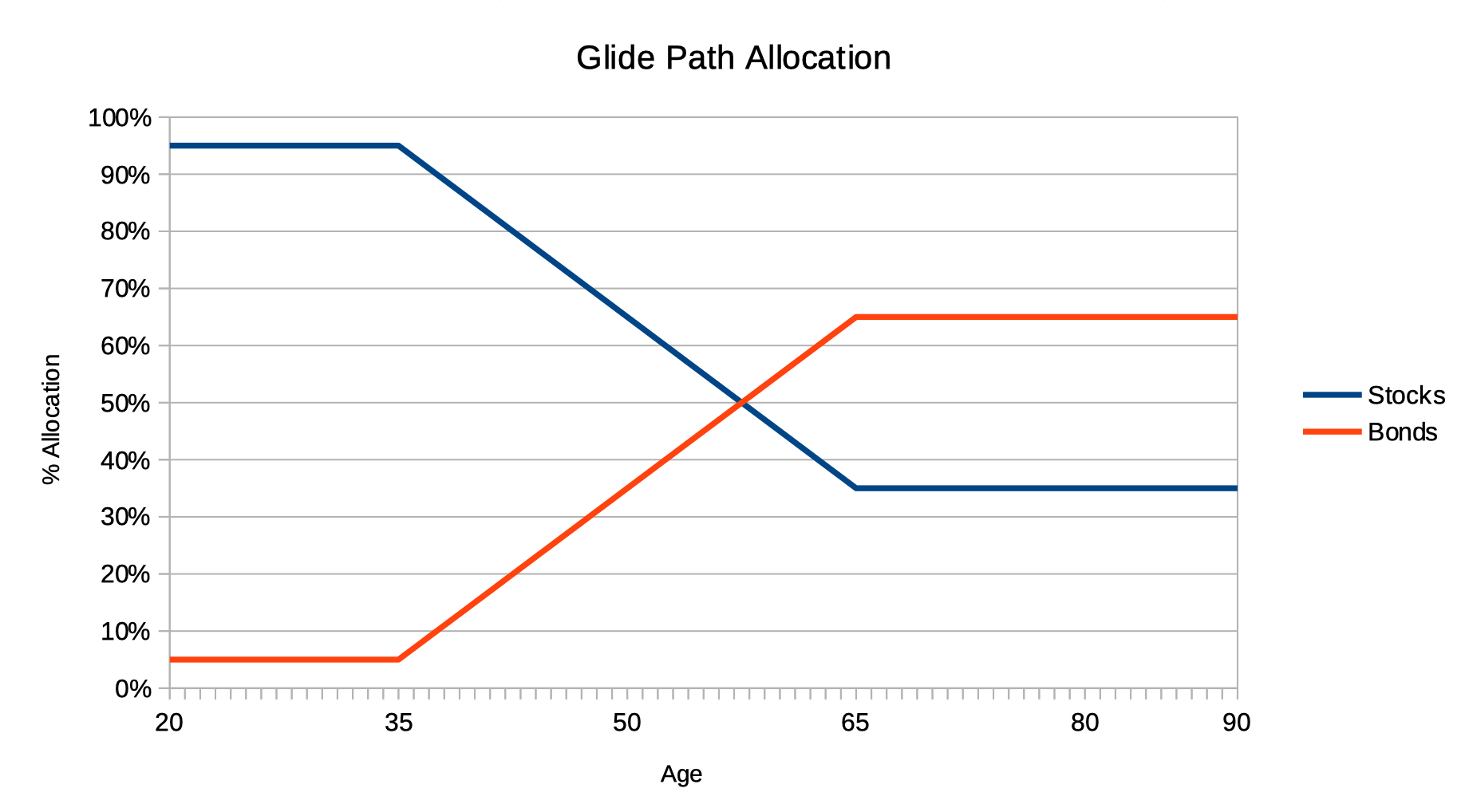

This is accomplished by the fund gradually shifting out of stocks and into bonds as the target date approaches. That is called the fund’s glide path. It starts risky and slowly transitions to more conservative. This maximizes growth in the early years and protects capital in the later years.

In the graphs above the glide path bottoms out at age 65 at 35% stocks / 65% bonds. All the action is from ages 35 - 65 where it gradually shifts from stocks to bonds.

The steepness of the glide path and the starting and ending assets allocations will be stated in the prospectus. Some funds are heavier on international (ex-US) assets, REITs and commodities vs US stocks. Others will end up at a 50/50 stock/bond allocation once the target date is reached, others will be more conservative at 30/70.

Here are links to popular fund target date fund families.

- Vanguard Target Retirement Funds

- T.RowePrice Target Date Funds

- Pimco Real Path Blend Funds

- Fidelity Freedom Target Date Funds

- American Funds Target Date Retirement Series

Features Of Target Funds

The main reason why retirement planners prefer target-date funds is owing to their comprehensive nature and low cost.

Easy for Investors

If you wish to have a hands off approach to your retirement plan a target date fund is a great way to go! Once you set up automatic contributions you will be riding the glide path automatically. It is like enabling auto-pilot mode for your retirement plan.

Risk Tolerance Flexibility

With a target-date fund plan, you do not have to stick to the same plan till the maturation of the fund. If you decide the glide path isn’t for you anymore you can always switch to a different fund or redesign your portfolio from the ground up.

Wide Level of Diversification

With target-date funds you do need not worry about putting all your eggs into one basket. Your investment will be spread across a wide swath of stocks, bonds and other assets according to the fund’s prospectus. They say diversification is the only free lunch on Wall Street, and that is a key component of what they offer.

LifePath / Target date funds vary widely in what they hold and in what percentages. So you will need to read the prospectus to understand what you are actually buying into.

Example holdings include the most common asset classes:

- Domestic bonds

- Foreign bonds

- Small-caps, mid, and large domestic equities

- Foreign equities

- Cash-equivalent instruments

- Commodities and precious metals

- Real Estate Investment Trusts (REITs)

Low Expenses

Most target date funds are set up with low fees (also known as the expense ratio). The lower the fees the higher your returns and the more compounding you enjoy on your contributions. Compare the expense ratios of the funds available to you and see if the target date funds are a good deal expense wise. They may be slightly more expensive than a pure index fund (since managing the glide path is more work). However it may be better to design your own 2 or 3 fund portfolio if the target date funds have high expense ratios (above 0.5%).

Wrapping It Up

LifePath and target-date funds provide a simple and comprehensive solution to saving for retirement or college. They work well because once you set it up they do all the work of rebalancing and gradually reducing your risk profile as the target date approaches. Securing your future in an automated, convenient way has never been easier!