In Case of Death Template

Not many people like to ruminate on the idea of their own death—or, even worse, dying with their spouse and leaving behind orphaned children. And yet… it does happen—both death at a young age, and even death of two young parents at the same time. Whether you’re married or single, with minor children, adult children or no children, having clear instructions and information available to after your death (or, for that matter, if you are incapacitated) can make a big difference in ensuring that your wishes are fulfilled and your loved ones are taken care of.

If you’re single, chances are your finances aren’t commingled with anyone, so it’s especially important to make sure you have detailed information available in case of your death. If you’re married, you should include enough information in the packet so that someone other than your spouse—who might have died with you—could take care of your affairs and/or your children. Not all married couples have commingled finances, so having this information available would also mean that your spouse could easily find and access any accounts held in your name only. If you’re married, each partner should complete one of these “in case of death” lists.

Keep this list in a safe place, ideally in a packet near or with your Will. A fireproof safe in your home, a safety deposit box, and/or with your lawyer are good places to keep this information. If you decide to store it digitally take precautions because of how juicy this information would be to an identity thief - see our post on The Basics of Digital Security.

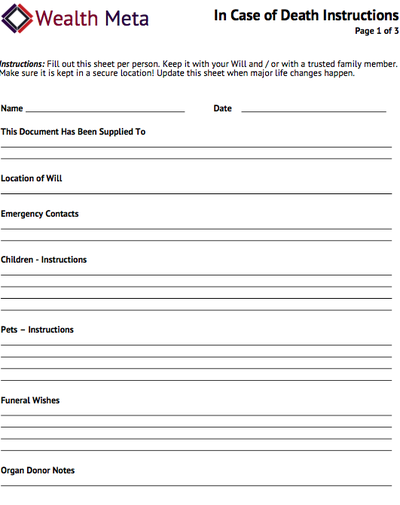

Instructions:

First page is a general overview of the most important items:

- Who has been provided this document? Good for everyone involved to know "who knows what".

- Where is your Will and other important paperwork located?

- Emergency Contacts - list at least two people who should be notified immediately of your death.

- Instructions for Children - include legal guardians, allergies / medications, contact information, school information, who can help out.

- Instructions for Pets - feeding schedule, medical issues, who can lend a hand.

- What are your wishes regarding a funeral?

- Are you an organ donor?

The second page is a list of life insurance, bank accounts, retirement accounts, major real estate, and passwords / PINs for all your devices and online accounts.

- List your life insurance policies (provider, policy number, policy value, and expiration date if applicable)

- List your bank accounts (financial institution, account #, login details)

- List your retirement accounts (institution, account number, login details)

- List your major real estate holdings (primary home, vacation home, rental, etc)

- List your digital devices / accounts and passwords. Include the following types of accounts:

- Laptop

- Phone

- Desktop computer

- Email accounts

- PayPal account

The third page is open ended and could include things like:

- What valuables do you own, and where are they located?

- List your regular bills (electricity, property taxes, water, etc), the account number for each account and when the bill is due. Also note it the bill is set up to autopay.

- Any subscription services that require a regular payment

- List professionals whose service you use: your lawyer, accountant, regular gardener, property manager for a rental property you own, etc.

- Auto / home insurance policy information.

- Who should be contacted at your place of employment in case of your death?

- Are there any sentimental items you want to ensure are held on to for your children? List any items here, as well as where to find them and the story you want your children to know about them.

- Anything else you think your loved ones should know if you were to die.

- When in doubt, include it.

This sheet should be updated any time one of the answers to the questions change, but especially if you change jobs, move to a new home, get married, get divorced, have more children or experience any major life changes.