Student Loan Calculator

Student Loan Calculator Details:

This calculator assumes a fixed interest rate for the loan, but not all student loans have fixed rates.

A complete amortization table is available by clicking the Show Payment Schedule button below the graph. It displays a complete breakdown of the balance, amount paid, interest, and principal per payment.

Are you interested in refinancing your loan? Check out our Loan Refinance Calculator. Interested in consolidating multiple loans into one loan? Check out our Loan Consolidation Calculator.

Field Summary:

- Loan Amount - how much you are borrowing.

- Loan Term in Years - how many years the student loan will last.

- Interest Rate - the interest rate the bank will charge you for this loan.

- Additional Monthly Payment - the extra amount you want to pay each month in addition to the minimum monthly payment (optional, but highly recommended to at least play with it and see the impact).

Things to Consider With a Student Loan:

- By making an additional monthly payment you can make back a lot of money and time from the loan. There is nothing wrong with paying ahead on a loan and it is a great habit to get into. Some loans (from really crappy, evil companies) do have prepayment penalties, so check into that before signing.

The Math:

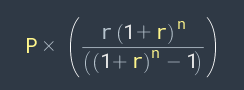

To calculate a monthly payment for an amortized student loan, use the formula:

P = principal, the amount being borrowed

r = monthly interest rate, eg a 7% annual loan would have an r value of = 0.07 / 12 = 0.005833

n = total number of payments (3 year loan = 12 * 3 = 36 payments)

Share this Calculator

To share this calculator by URL or embed it on your own website see the 'Share / Embed' button above next to the results bar after hitting Submit.

If you are interested in customizations or would like to embed our calculators in your site without our branding applied please contact us.