Mortgage Loan Calculator

This calculator assumes a fixed interest rate for the loan and does not take into account any other fees that may be associated with your home purchase such as title fees, closing costs, etc.

A complete amortization table is available by clicking the Show Payment Schedule button below the graph. It displays a complete breakdown of the balance, amount paid, interest, and principal per payment. The amortization table accounts for inflation (if a value is provided), and the expected final payment is calculated based on inflation's impact on taxes, insurance, and HOA fees.

Are you interested in refinancing your loan? Check out our Loan Refinance Calculator. Interested in consolidating multiple loans into one loan? Check out our Loan Consolidation Calculator.

Field Summary:

- Loan Amount - how much you are borrowing for the house (subtract any down payment).

- Loan Term in Years - mortgages are typically 30 or 15 years, but this calculator allows several options including a custom loan term.

- Interest Rate - the interest rate the bank will charge you for this loan.

- Annual Real Estate Tax - the taxes per year on the house paid to the county / city where the property is located.

- Annual Home Owner's Insurance - the cost for an insurance policy on the property.

- Monthly Home Owner's Association Fees - typically only for condos or properties that are part of a community, HOA's often go towards exterior maintenance, pool upkeep, parking lots, etc.

- Inflation Rate - the expected rate of inflation over the life of the loan (optional).

- Additional Monthly Payment - the extra amount you want to pay each month in addition to the minimum monthly payment (optional, but highly recommended to at least play with it and see the impact).

Things to Consider With a Home Loan:

- Over time your payment will increase! That is true even if you have a fixed rate loan. But how can the payment go up on a fixed rate loan!? The payment goes up because the taxes + insurance on your house (the escrow portion of the payment) will almost always increase a little bit each year. The tax portion can go up to due to the assessed value of your home increasing. Tax increases can also come from new bond measures for schools, public works, etc. The insurance premium can rise due to inflation (prices going up slowly most of the time) and the insurance company jacking up rates. Every year the bank will do an 'escrow analysis' to figure out your new payment. The same is true for any HOA payments which are typically handled outside of escrow, but every year maintenance costs may go up with inflation too.

- Fixed rate loans set a floor for your minimum payment (except the increases in the taxes + insurance mentioned above). With a variable rate mortgage your payment may go up if interests rates rise or the bank is allowed to raise your rate per the contract.

- Some people like going for a 15 year loan because they want to pay off their house faster. Not having a mortgage is a game changer in life and a very admirable goal. It is correct that a 15 year loan will be paid off sooner than a 30 year loan, assuming minimum payments are made. However, with the 15 year loan, the minimum payment is much higher than the 30 year loan. You can get some flexibility for free if you opt for a 30 year loan, which comes with a much lower minimum payment, but pay it on a 15 year schedule! Then if something goes wrong financially you have some maneuvering room. There is nothing wrong with paying ahead on a loan and it is a great habit to get into. Some loans (from really crappy, evil companies) do have prepayment penalties, so check into that before signing.

- Before buying a home, many people get quotes for what it will cost to insure it. They also consider flood and earthquake insurance which are typically not covered in a basic home owner's policy.

The Math:

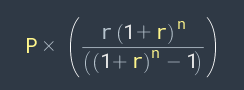

To calculate a monthly payment for an amortized home loan, use the formula:

P = principal, the amount being borrowed

r = monthly interest rate, eg a 7% annual loan would have an r value of = 0.07 / 12 = 0.005833

n = total number of payments (30 year loan = 12 * 30 = 360 payments)

Share this Calculator

To share this calculator by URL or embed it on your own website see the 'Share / Embed' button above next to the results bar after hitting Submit.

If you are interested in customizations or would like to embed our calculators in your site without our branding applied please contact us.