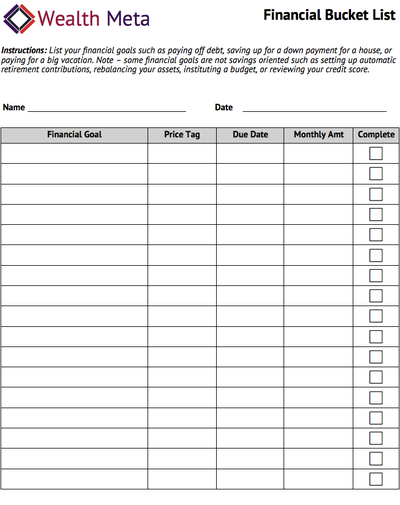

Financial Bucket List

What is a Financial Goal?

We’re taking a pretty broad definition of financial goal—it’s expenditure that you can’t just make on a whim, but requires planning and saving. This means that there’s no specific dollar amount, because the type of purchase that requires planning for some would be just a swipe of the credit card for others. We tend to think any purchase over $500 merits some thought, even if you have five times that much in your checking account at any given moment.

Financial goals can be fun, like a family trip to Europe. Or they can be less sexy, like paying off your student loans. They can also be financial tasks like adding up your net worth, or automating your retirement contributions.

The idea is to write down your goals, figure out how much the total cost is, set a deadline for when you’re like to accomplish the goal and then figure out how much you’ll have to put away (or pay down, if you’re paying off debt) to meet the goal.

Here are some examples:

Pay off student loans

Price tag: $67,288

Deadline: 5 years from now (60 months)

Monthly payment: $1,121

Buy a fancy cargo bike

Price tag: $1,600

Deadline: 12 months from now

Amount to save monthly: $134

Here are some other examples of things that might be on your financial bucket list:

- Save up for a 20% down payment on a home

- Build up a certain amount in an investment account—you set your own number, it could be $100,000 or $1 million.

- Pay off all debt, including car loans, mortgages, credit cards and student loans

- Take your children on a two-week trip to Europe

- Take a year sabbatical and use the time off to do whatever you want—travel, work on hobbies, stay at home with a baby

- Big date night - see a live show then eat at a really awesome restaurant

- Attend a road game for your favorite sports team

- Drive across the country

- Take a two-month vacation with your kids over their summer vacation

- Buy a new (to you) car

- Upgrade your home’s energy efficiency

- Remodel the master bathroom

Note – some financial goals are not savings oriented but focus on getting financially organized such as:

- Setting up automatic retirement contributions

- Choosing an asset allocation

- Rebalancing your assets

- Instituting a budget

- Reviewing your credit score

- Switching insurance companies to save money

- Locking your credit

- Getting a will in place

- Completing the in case of death template

Everyone’s financial goals are different, so this list will look different for everyone. Writing down your financial goals and figuring out exactly how much it will cost to reach them is the first step to making sure you’re using your money to reach your goals.

Also check out our post on a reverse bucket list, the things to avoid doing in order to attain financial freedom faster.