Savings Goal Calculator

This calculator assumes that interest compounds monthly and that the interest rate is fixed.

Field summary:

- Savings Goal - how much money you want to have saved.

- Starting Amount - how much you currently have saved, can be negative if you are in debt.

- Growth Rate - this is the interest rate on your savings, also called the yield or the annual return on your savings.

- Years to Save - how many years you give yourself to meet your goal.

Some things to think about with savings:

- The higher the growth rate the higher the risk. Remember there is no 'free lunch' on Wall Street, with the one exception - diversification. Having your assets spread across a multitude of asset classes as opposed to a few concentrated areas eliminates the possibility of getting rich quick, but makes your portfolio very efficient from a risk vs return standpoint.

- The more time you give yourself to save the better. Extra time gets the power of compound interest working in your favor.

The math:

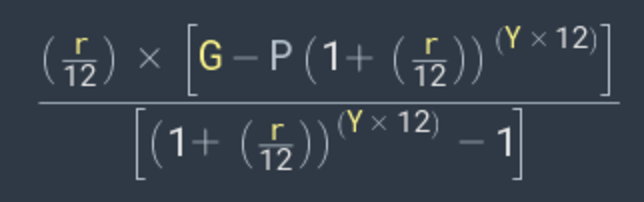

In order to calculate what you would need to save per month to reach a savings goal, use the formula:

r = annual interest rate, eg 7% = 0.07

G = savings goal

P = amount already saved

Y = number of years to save for

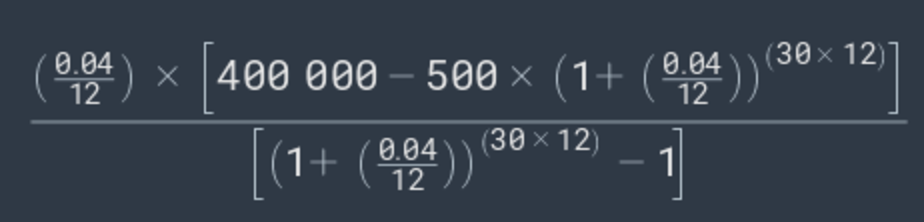

For example, if r = 4% (0.04), G = $400,000, P = $500, and Y = 30:

Which equals $537.94, just as the calculator shows!

Share this Calculator

To share this calculator by URL or embed it on your own website see the 'Share / Embed' button above next to the results bar after hitting Submit.

If you are interested in customizations or would like to embed our calculators in your site without our branding applied please contact us.