Auto Loan Calculator

This calculator assumes a fixed interest rate for the loan and does not take into account any other fees that may be associated with your car purchase such as title fees, insurance, etc.

A complete amortization table is available by clicking the Show Payment Schedule button below the graph. It displays a complete breakdown of the balance, amount paid, interest, and principal per payment.

Are you interested in refinancing your loan? Check out our Loan Refinance Calculator. Interested in consolidating multiple loans into one loan? Check out our Loan Consolidation Calculator.

Field Summary:

- Loan Amount - how much you are borrowing for the car (subtract any down payment or trade in).

- Loan Term in Years - how many years the car loan will last.

- Interest Rate - the interest rate the bank will charge you for this loan.

- Additional Monthly Payment - the extra amount you want to pay each month in addition to the minimum monthly payment (optional, but highly recommended to at least play with it and see the impact).

Things to Consider With an Auto Loan:

- By making an additional monthly payment you can make back a lot of money and time from the loan. There is nothing wrong with paying ahead on a loan and it is a great habit to get into. Some loans (from really crappy, evil companies) do have prepayment penalties, so check into that before signing.

- Increasing the duration of a loan (which lowers the payment) can come with consequences. For example, if you go with a 7 year loan on a car just so you can make the payment 'work' you may find that a longer loan term will make the payment less, but it will drastically increase the total cost of the loan. That would make the car even less affordable over time. While a loan has an outstanding balance the clock is ticking on the interest. The bank likes it that way. The longer the duration of the loan, the more that clock ticks. A longer duration loan can provide flexibility in the form of a lower minimum payment if you are allowed to pay ahead on the loan without penalty.

- The sales person at the car lot will often ask you "what maximum monthly payment works for you?", then they may recommend a longer loan term so you can get "more car for your payment". What the sales person is actually doing is maximizing their commission, and in the process extracting as much money from your pocket as possible. It is your responsibility to consider the price of the car, plus the interest as part of the overall deal. The sales person will have you sign some fine print containing legal details before finalizing the deal. Somewhere in the legal paperwork it will state the total finance cost. Most people will just ignore the finance cost and happily sign because they got such a "great deal" on such a "super car". Savvy buyers pay close attention to the interest on the loan! Interest is a large part of the total cost of owning a car when using a loan to make the purchase.

- Unlike with a house, with a car it is almost guaranteed you will be under water immediately. Being under water means the value of the car is less than what you owe on it. Cars start off under water because they depreciate (lose value) as soon as they are driven off the lot. They continue to depreciate much faster than the loan balance drops as you pay it off. When your car is under water you are trapped with it unless you want to default on the loan which could negatively impact your credit rating. A longer duration loan also means being under water deeper for a longer period of time!

The Math:

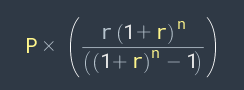

To calculate a monthly payment for an amortized car loan, use the formula:

P = principal, the amount being borrowed

r = monthly interest rate, eg a 7% annual loan would have an r value of = 0.07 / 12 = 0.005833

n = total number of payments (3 year loan = 12 * 3 = 36 payments)

Share this Calculator

To share this calculator by URL or embed it on your own website see the 'Share / Embed' button above next to the results bar after hitting Submit.

If you are interested in customizations or would like to embed our calculators in your site without our branding applied please contact us.