The Golden Rule: Keep Your Investment Costs Low

- March 31, 2017

- by Steven

Want a bigger slice of the pie? If you desire financial independence, remember to keep your investment costs low because you put yourself in position to lose less money. And likewise, you’re in better position to keep more money. Money which can compound into a massive nest egg.

To give you an idea of the importance of investment costs, imagine the stock market as a zero sum pie. A pie which represents the total market return before costs.

Meaning, as Vanguard founder and index fund pioneer John Bogle points out:

“If we aggregate the returns of all investors who do better, those returns must be offset by the aggregate returns by all those who who do worse, and by precisely the same amount.”

This says that if the gross return of the market is 10% (the whole pie). And the "winners" earn 12%, then the "losers" must earn a smaller portion, 8%—because the pie represents a 10% return.

And this is before accounting for costs, which you inevitably lose money to when investing.

So if all investors incur 2% investment costs, 2% of the pie is now off limits. And thus "winners" ultimately earn 10% (12% minus 2%, which is equal to the original market return) and “losers” 6%.

In other words, the “winners” didn’t win! If winning is defined as beating the market because they earned the market — which in our example had a 10% return overall.

What the pie analogy shows is the difficulty of "beating the market." Particularly so because investment costs drag you down.

Just pretend you’re climbing a mountain. And each time you’re about to reach the top, a rock comes tumbling down on you and blocks your progress. This is how fees, such as expense ratios, work.

Because even if your mutual fund or ETF outperforms the market, investment costs come crashing down on you. And you have to subtract these costs from the fund’s total return because the only return that matters to you is the return in your hands. That’s all you care about: your return—after costs.

Let’s revisit the pie analogy, from the perspective of Bogle:

- All investors own the entire stock market, so both active investors (as a group) and passive investors—holding all stocks at all times—must match the the gross return of the stock market.

- The management fees and transaction costs incurred by active investors in the aggregate are substantially higher than those incurred by passive investors.

- Therefore, because active and passive investments together must, by definition, earn equal gross return, passive investors must earn the higher net return. QED.

All this means, you’re in a better position to build greater wealth if you simply do this one thing: limit how much you spend on investment fees.

The more you learn about investing, the more you realize investing, like life, is about energy allocation. You focus your energies on the things you can control and you discard all that you can’t. Because trying to control what you can’t only brings worry.

Investment costs are one thing fully in your control. In the sense that you decide whether you choose a mutual fund with an expense ratio of 0.05% versus 1.00%. You will be the wiser (and richer) to make it part of your investing strategy, all things equal, to select the lower expense ratio.

Suppose you’re faced with the following real-world scenario:

You have $100,000 to invest. And you’re considering investing it in Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX). A broad-based, well-diversified passive index mutual fund which comes with an expense ratio of 0.05%. VTSAX is straightforward: if the U.S. stock market does well, you do well. And vice versa. I picked VTSAX for this article because it is a good example of this type of fund, but you should do your own research and come to your own conclusions on what fund works the best for you.

At the same time, you’re weighing an alternative option, which is to give your money to a financial advisor referred to you by a friend. The financial advisor is a smart guy. He speaks well and appears confident. And makes a case that he can help you grow your money.

Tucked away in his pitch is the fact the he charges a 1.00% annual management fee, a very realistic rate you will find financial advisors peddling. Which means you’ll pay him 1.00% of your portfolio yearly—no matter if you are earning or losing money in a given year.

What are your costs in dollars here?

For VTSAX, you purchase $100,000 in shares for $50 per year because 0.05% (the expense ratio) of $100,000 is $50.

For the financial advisor, you pay $1,000 dollars for every $100,000 because 1.00% (his fee) of $100,000 is $1,000. But that’s not all you owe because the manager hasn’t yet put your money anywhere. He’s going to invest in investment vehicles that have expense ratios, commissions, among other fees. All of which you will pay too!

It follows that the financial advisor needs to not only outperform the U.S. stock market—no small feat—but outperform it by such a large margin that after fees are subtracted, your return is still greater than the U.S. stock market. And remember you're a long-term investor. You need your manager to do this for decades.

Suffice it to say, on average and over a long-term investing timeline, you will lose money if you give your money to an financial advisor who charges a 1.00% portfolio fee as opposed to investing it in a broad-based ultra-low cost passive index fund like VTSAX.

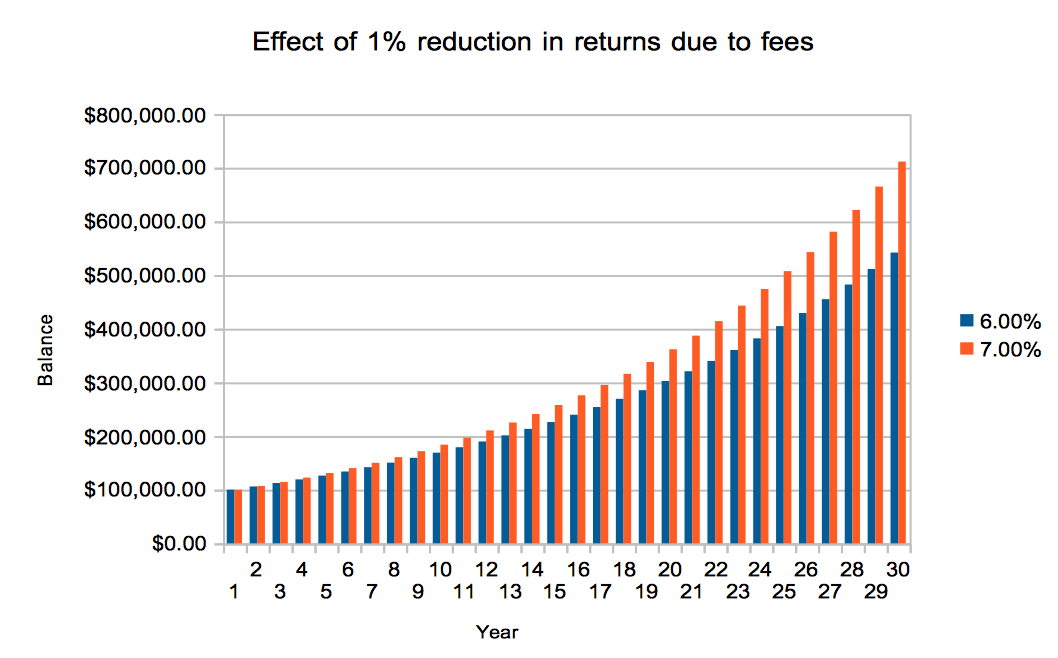

To visualize how profound an effect the difference in fees is, try these two compound return scenarios using Wealth Meta’s Compound Interest Calculator.

Scenario 1 - Buy VTSAX on your own

- You invest $100k in VTSAX through your discount broker.

- Over 30 years it provides yearly a 7% return.

- And results in $761,225.50.

Scenario 2 - Financial advisor

- You hand over your $100k to a financial advisor who charges 1% per year, but does nothing more than turn around and buy VTSAX.

- The return is just 6% per year (since he is taking a 1% cut).

- And the balance after 30 years is $574,349.12.

That is a difference of $186,876.38! Just from picking a low cost fund yourself vs paying a so-called ‘financial advisor.’ A financial advisor who probably doesn’t do much aside from gouging you for 1% of your portfolio and maybe massaging your ego now and then.

High investment costs are burglars of the night. They slip into your portfolio and steal your returns when you’re sleeping and threaten compounding. And they knock you off your path to financial independence.

Thus, remember the Golden Rule: keep your investment costs low.

Notes:

- Remember that all investments are subject to risk, including the possible loss of the money you invest.

- Remember to read your fund’s prospectus because it’ll spell out the fees you owe.

- The market as a pie analogy comes from “Common Sense on Mutual Funds” by John Bogle, page 25-26.