Bank Statements - How and Why To Read Yours

- August 19, 2022

- by Angela

Do you think banks are always 100% accurate when handling your money? With many thousands of clients and millions of transactions, the answer is they can’t possibly be perfect all the time. That is why it is very important to learn how to read your bank statement. This article will serve as a guide to bank statements.

What is a Bank Statement?

The name itself tells us that the document from your bank and contains data from your account including:

- The final balance on your account at the time the statement was issued

- When and how much you paid into the savings account (income)

- How much you withdrew from the account and who you paid with that money (expenses)

- Any bank adjustments such as monthly fees, interest, etc.

- Credit card statements it will also include interest charges, fees, and a summary of your points if the card offers that.

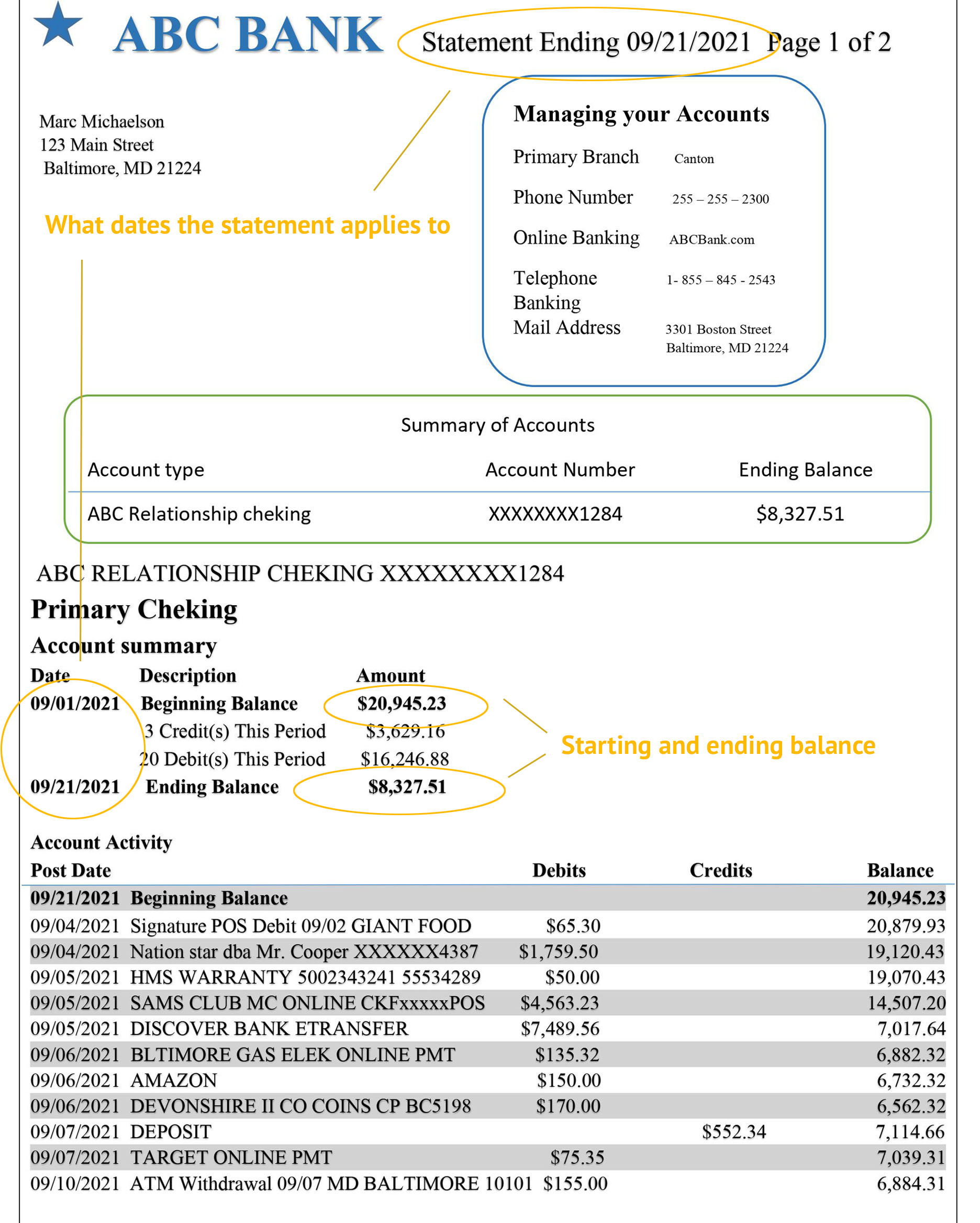

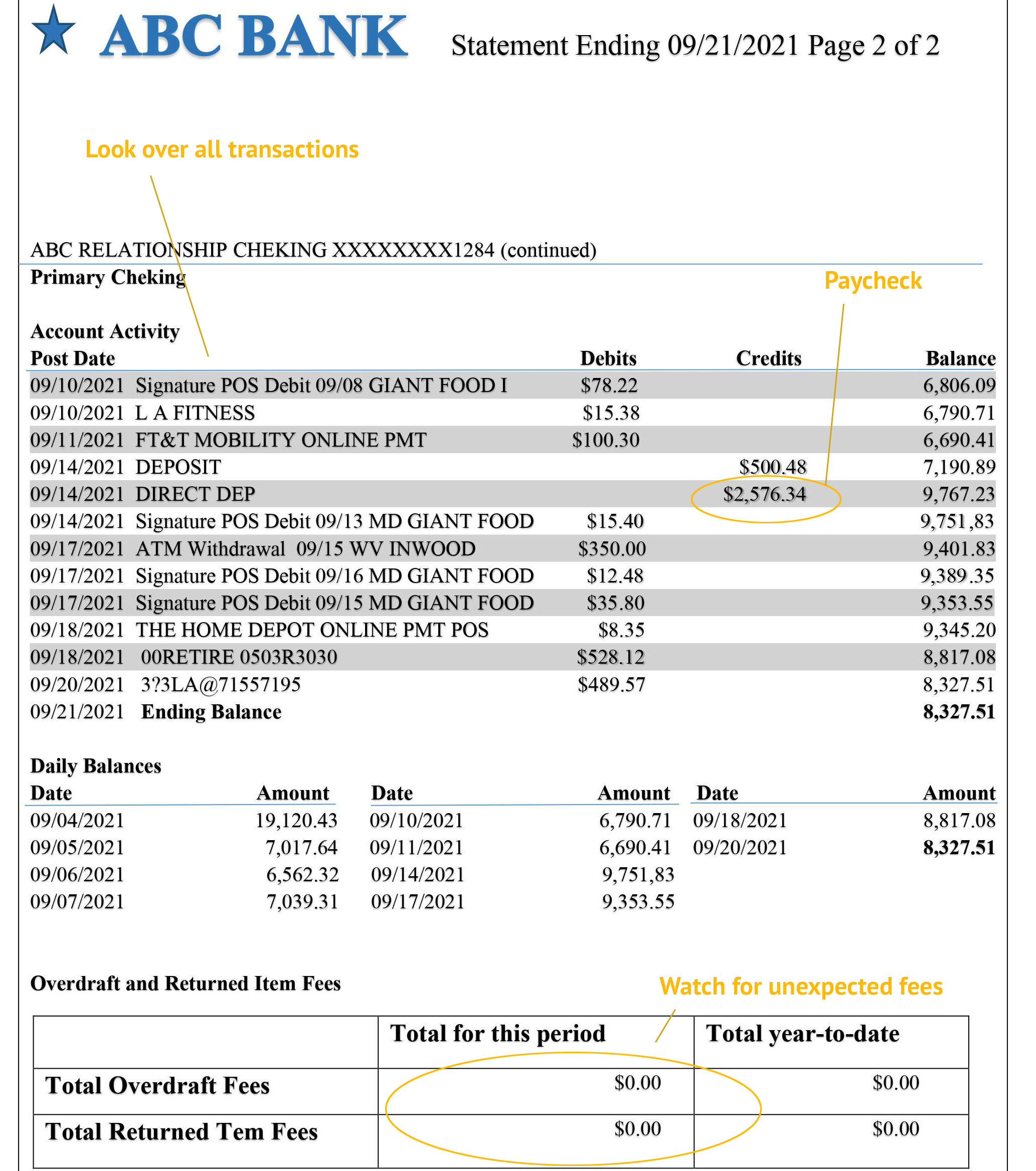

How to Read a Bank Statement

Here are the basic terms found in a bank statement:

Starting balance - The starting balance is the amount you had at the beginning of the period, typically the first of the month. Deposits and withdrawals on the account go towards or against this figure.

Ending balance - This is the amount you have at the end of the statement period. If you save more money than you spend your balance will be higher than in the starting balance. If by any chance you happen to spend or transfer more money, know that you will have less than the starting balance.

Deposits - these are individual payments of funds to your account. They can be of different types such as your employer's direct deposit, cashed checks, bank transfers, the money you have transferred from Paypal or Venmo, and other credits.

Withdrawals - This section of the document shows all the amounts of money you have withdrawn from your account, including online transfers, such as payments to your credit card or transactions that have occurred with your debit card. Fraudulent transactions may also appear on your bank statement. These are transactions that occurred if someone stole your credit or debit card. If you reported the theft of a credit or debit card to the bank, this would have been prevented, because the bank would have automatically blocked your stolen card so that no one else could use it.

Interest - when you have a savings account, the bank computes the interest you earned each day (based on that day’s balance) and then credits you the total amount at the end of the month. With credit cards, the interest calculation works the same, except since a credit card works like a loan, you are charged the interest as a fee. Credit card interest rates are typically MUCH higher than interest rates on a savings account.

Fees - Each bank has its list of fees. In general credit unions have much lower fees compared to banks. These fees may relate to a simple monthly fee for having the account, overdraft fees, returned checks, withdrawals from domestic and foreign ATMs, annual card maintenance fees that vary from bank to bank, fees for foreign transactions if you have used your card abroad.

Daily balance detail - This refers to your daily expenses. You can get a statement at the end of the day and find out how much money you spent during the day. So you can have control over your monthly balance and see how it varies, but also have an insight into your consumer habits.

Statement period - this part indicates when the transactions took place, most often it is a calendar month (January 1st - January 31st). But if the statement says "January 2022", but has a statement period from December 20th - January 20th, it would include some transactions from December 2021 as well.

Overdraft protection - each bank account can have a feature called overdraft coverage enabled. With a checking account or debit card this happens if you draw out more than you have available. With credit cards a similar thing happens if you exceed your credit limit. What the bank does in that case is cover the amount by pulling from another one of your accounts. However, they charge a hefty fee each time this happens. If you are able to keep some extra money in your account as a cushion it may be better to turn off overdraft protection because thieves love this feature.

How to Use Your Bank Statement

Now that you have learned what a bank statement is and how to read it, now I’ll show you how to use your bank statement.

Keep them organized

The first thing to do is to keep your statements organized and in a safe place. If you signed up for paperless delivery you probably receive bank statement notifications by e-mail every month. When you log in to your banking app or website you can download and save them in a dropbox or encrypted disk. If you get them in the mail you can scan them in and then shred the original or lock it in a safe place. I name my statements by year, month, and the bank name, for example, “2022-01 ABC Bank.pdf”’. That way they are easy to find.

Reconcile the Transactions

You've probably seen your parents compare their expenses to a checkbook or a stack of receipts. The checkbook is a history of expenses and should match up with the lines on the statement. Today you can also get receipts via email and text. In any case, what you want to do is make sure that a) every purchase you made shows up correctly, and b) there are no purchases you didn’t expect. That process is called reconciliation.

Reconciliation is an accounting term used to determine whether the transactions you think you made line up with the transactions the bank claims were made. If they are not equal, it means that there is a mistake somewhere. If the problem is on the bank’s end, it is up to you to contact the bank's customer service and get them to resolve the error.

What else can we use a bank statement for?

You can use the bank statement for:

- monthly budget planning

- verification bills were paid (proof if needed)

- managing your savings

- verifying your paycheck amount

- if you have your own business, you can track your income and expenses through a bank statement.

Confirm your paycheck / direct deposit came incorrectly

Direct deposit has been automated for the last 20 years, which means that most employers will pay you electronically vs giving you a paper check. On pay day the account department “processes payroll” and the next day the funds should be available. You’ll want to watch closely for that deposit and verify it on your bank statement. Also make sure they amount that was deposited matches the paystub your employer provided you. In rare occurrences something gets lost or the amount is wrong which means you’ll need to check with your accounting department and possibly your bank.

Check how much interest you earned

For accounts that earn interest, like a savings account, each month the bank will pay you a dividend based on your balance. If your balance is off by a few cents, it is probably because the dividend came through and you need to record that in your budgeting software or spreadsheet.

Your bank statement will show the transaction for the interest dividend, and should have a section that shows your dividends year to date.

Check your rewards points balance (for credit card statements)

Many credit cards offer reward points or a rewards cash balance just for using them. You will earn more reward points if you spend more money on purchases. When you collect enough reward points you get to access them. The number of points also depends on the type of card you use.

It can be fun to check these points on your credit card statement.

Make sure you have enough money for next month

For people who are budgeting for next month your bank statement's ending value lets you know how well you are setup for the upcoming month. To make sure you have enough for next month, refer to your bank statement, which is your official balance of funds you have to work with.