Why Home Ownership Is No Longer the American Dream

- July 5, 2019

- by Ashley

The Declaration of Independence says "all men are created equal" with the right to "life, liberty and the pursuit of happiness." These statements gave birth to the idea of the American Dream. One of the components of the American Dream has always been owning a home. In the past, homeownership has been a sign of status, wealth, and accomplishment. For many Americans, owning a home is one of their life long goals.

Yet, over the years, the American Dream has transformed. While homeownership remains a strong ingredient to the American Dream, other components are coming up the ranks. These ingredients include financial stability, debt freedom, pursuing your passion, and other financial milestones.

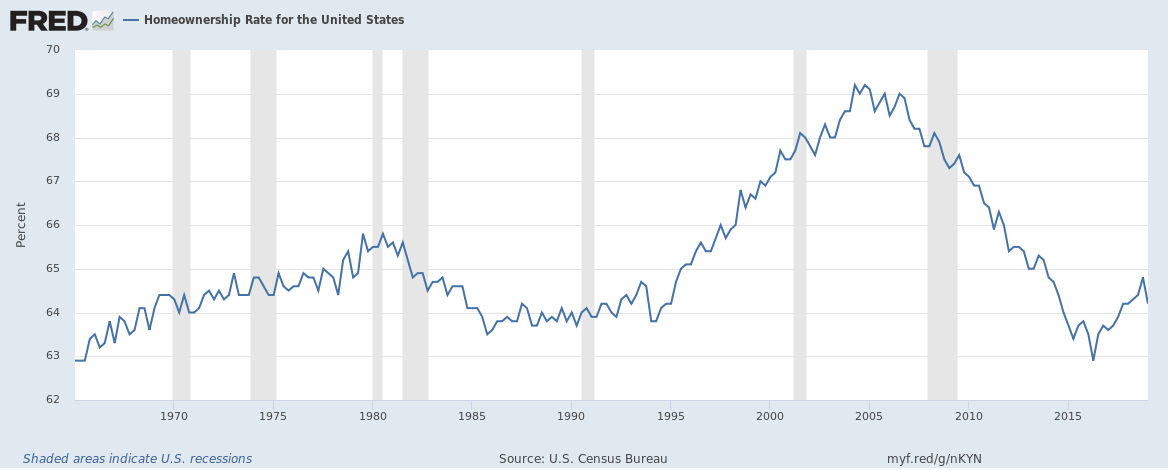

Home ownership peaked at around 69% in 2004 and is currently around 64% after bottoming out at 63% after the great recession. A comprehensive 2016 Trulia report breaks down who went from being an owner to a renter over that time period.

Home Ownership Rate 1965 - 2019

Home Ownership Rate 1965 - 2019

With the increase of popularity of the FIRE movement (financial independence retire early), the American Dream is no longer just about the pursuit of financial mobility and homeownership. Americans are prioritizing their lifestyles and happiness over monetary possessions. Many Americans want to retire earlier and travel more often. Having financial obligations such as a home can hold them back from achieving this level of freedom.

Here are a few reasons why Americans may be forgoing this American Dream for the chance of financial stability and prosperity.

Home Ownership Limits Flexibility

Getting into and out of a home is expensive in both directions. Before purchasing a home you need to evaluate your dreams and goals, where you might be living and working 5-10 years from now.

Purchasing a home leaves a big dent in your wallet. A down payment costs tens of thousands of dollars, let alone all of the moving costs, repairs, and furniture purchases. This blow to your budget can take a long time to recover. This is true even considering first time home buyer perks.

When selling a home, even though Zillow might say it is worth $500k, you won’t get that amount after the deal closes and everybody else takes their cut. Fees when selling a house can be as much as 10%, including your real estate agent’s fee, the buyer's agent fee, title insurance, taxes, repairs, etc.

So, what happens when you need to move within a year of your purchase?

Whether you have a promotion opportunity in another state or you come down with a case of wanderlust, owning a home limits you mobility.

You will have to eat the move in costs and the seller fees, which isn’t very efficient. One option is renting out your property but that requires learning about being a landlord, advertising, collecting rent, and dealing with maintaining the property from far away.

As you pay down your mortgage, the principle amount slowly increases until you reach your break even point. A typical break even point is 5-10 years, depending on how the real estate market does in general. At this point you could sell your home with enough money to cover the cost you’ve incurred and use the proceeds for a downpayment on the next house.

Houses are Relatively Expensive

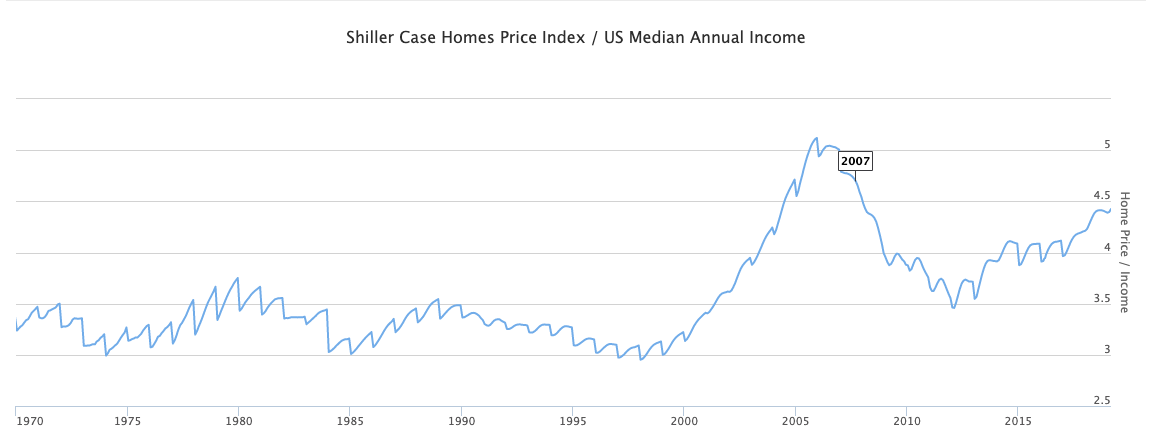

Homes are considered affordable if the price is roughly 2.6 times household income. Currently the ratio is about 4.4 and climbing back towards the 2008 peak of around 5.1.

Ratio of Home Prices to Household Income 1955 - 2019

Ratio of Home Prices to Household Income 1955 - 2019

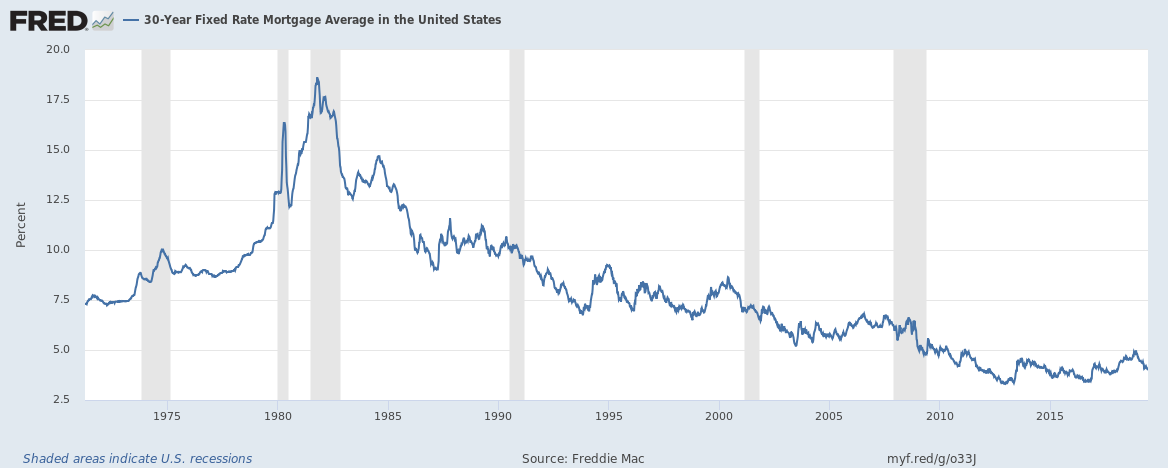

Mortgage interest rates have increased slightly off their lows. This makes homes more expensive due to higher monthly payments. Historically rates are still very low, but they have nowhere to go but up.

30 Year Fixed Mortgage Rates 1971 - 2019

30 Year Fixed Mortgage Rates 1971 - 2019

Other Ways To Invest in Real Estate

You can reap the financial benefits of real estate without purchasing a home. As a landlord, you can capitalize on real estate ownership without being stuck in one place. Owning multiple properties has advantages such as tax benefits, rental income, helps you hedge against inflation, and the possibility of asset appreciation.

However, not all Americans want to own and manage properties. And, that’s understandable considering it takes time, effort, money and research in order to maximize your returns and keep your properties in motion. But, there are other options to stay mobile without diving into the real estate market that may help you prosper. One example are Real Estate Investment Trusts (REITs) which are traded on the stock market as ETFs or mutual funds. You can invest in these by opening an account with a brokerage firm. They essentially pool a collection of investment properties across a wide range of markets and are required to pay a high percentage of their income in the form of a dividend. REITs tend to move with the overall housing economy. There are specific types of REITs to fit different strategies - commercial, residential, foreign, etc.

Homes Appreciate Slowly Which is Boring For Some

Most American’s net worth is composed of their home’s equity. This has some drawbacks. Your home is not a liquid asset. Meaning it cannot be turned into cash quickly (you can’t eat it). What’s the point of tying up so much of your nest egg in an asset that costs you money every month and cannot be quickly converted to cash?

Most of the time, your home will not help you rapidly build wealth. You need to consider other assets that will help you become more financial secure and not rely on you home to produce a high net worth.

While we all need a place to live, we can determine the amount of money we are willing to spend on this expense. Whether you rent or own, you don’t have to spend an astronomical amount for a roof over your head. Instead of breaking the bank to pay for living costs, it’s more beneficial to use your extra cash to invest in assets that will provide a source of income in the future.

You may be think that your home will appreciate and provide a payday in the future, but you can’t predict the outcome. Home values generally track with inflation. Owning real estate is really a bet on a specific area’s population growth and overall investment.

Latent Risk Aversion

The 2008 economic downturn is hard to forget. Losing your job then watching your house value plunge 20% - 40% is no fun. Thousands of people were underwater on their homes for years because of the great recession. The memory of this is keeping many people on the sidelines.

Buying a home is a risk, but it comes with a reward too. Our blog post on Is Buying or Renting Better? Simulation Results showed that the home owner came out way ahead vs the renter. This was because they leveraged into the home with a 20% down payment and the house grew on average at 3% per year over 30 years. This does not capture the fact that in the short term real estate prices can drop sharply.

The bottom line:

The dream of homeownership is still a top priority among many Americans, but home ownership is well off the peak from 2004. If homeownership is one of your aspirations, it’s important to consider the financial impact buying a home has on your future. If you value freedom and flexibility, homeownership may not be right for you.