Is Buying or Renting a Home Better? Simulator Results

- November 1, 2017

- by Emily

Using the Wealth Meta Income and Spending Simulator, I ran a couple of tests to see if buying a home or renting would be better in the long run. It turns out buying is better given our assumptions, but that comes with some risk.

If you would like to change anything about these simulations there are two buttons in the upper right hand corner. Use the “Save As…” button to make a copy for yourself which you can edit. Or you can try the Compare button to experiment with variations and see the impact.

Rent vs Buy Setup:

I’ve used the same income and expense data for both simulations - both our renters and our buyers earn and spend exactly the same amounts on everything except housing:

- Expenses of $2,500 / month for on food, clothing, medical, utilities, transportation, etc.

- Income of $60,000 a year.

- They both start with a net worth of $64,000.

- For the buyer this is all in home equity (the down payment for the house).

- For the renter this is in an investment account that grows at 5% per year.

- No debt for either.

- The comparison is being made over the course of 30 years.

How much to spend on housing in our simulation?

Lenders and management companies have general standards for what a person can “afford” for housing. Mortgage lenders want to see a loan payment of 28% of income or less and the total payment (including taxes and insurance) of no more than 36%.

For the home buyer, assuming an income $60,000 per year, 20% down, and an interest rate of 3.9% for a 30 year fixed mortgage, the mortgage is approximately $256,000. That comes out to a total payment of ~$1500 / month which is 30% of income. I’ll use the $1,500 per month figure for the renter as well.

Renter's Simulation Details

If something goes wrong… the roof fails, sewer need replacing, the kitchen floods… it’s not your problem, from a financial point of view. You don’t need to pay for a new fridge or a new toilet. Aside from possibly paying for renters insurance (which is cheap, so let’s say $160 / year, what I pay for renters insurance), that’s the extent of your housing budget.

However, your rent will increase a little each year due to inflation. That’s called the “rent spiral”. So I’ve set the rent line to increase with inflation (set to 2%). In reality how the rent changes really depends on how popular your area is, or if you live in a city with rent control.

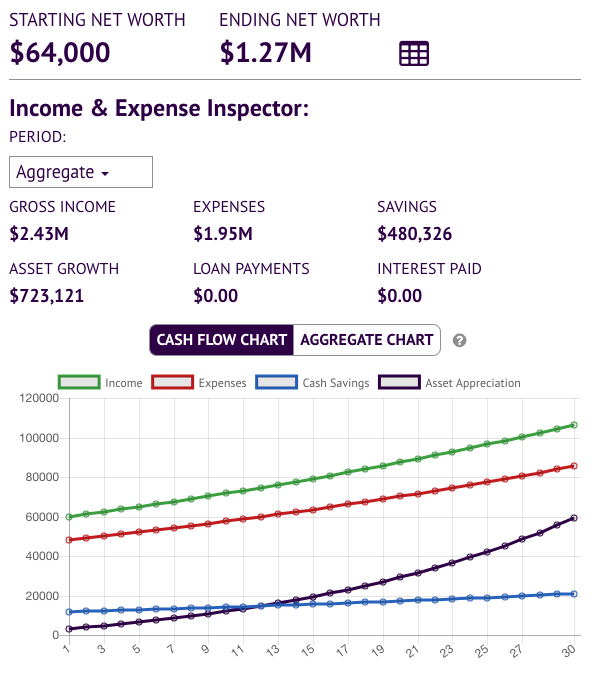

In the renter’s simulation, the net worth after 30 years comes out to $1.27M.

Buyer's Simulation Details

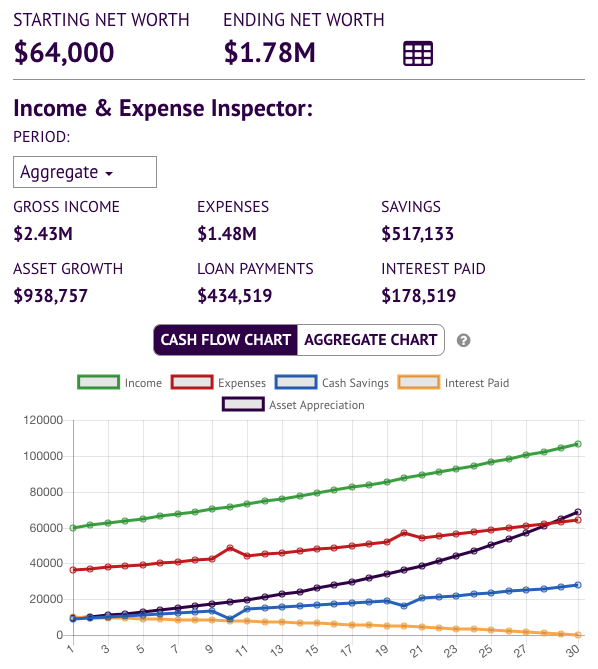

The buyer gets a mortgage for $256,000 on an $320,000 house, making a 20% down payment of $64,000.

At 3.9% interest, their monthly mortgage payment on a thirty year mortgage is only $1208. Woohoo!

Oh, but they are also paying for homeowners’ insurance ($500 / year) and property taxes ($3000 / year). In reality property taxes and insurance can vary substantial state to state. In addition they will pay slightly more for utilities (garbage collection is almost always paid by landlords and included in rent, whereas homeowners are on the hook for it themselves).

When you own a home, it is up to you to maintain it. Consider the roof needs to be replaced every 25 years or so. Or that dreaded winter day the heat doesn’t turn on because the furnace dies. Some call those things the "joy of home ownership". To cover upkeep I’ve allocated $2400/year for maintenance, plus planned upgrades of the furnace and roof.

Even accounting for all of these things, the buyer’s simulation shows a net worth of $1.78 million at the end of thirty years. That beats the render by about 40%!

Why the Buyer Came Out Ahead:

The buyer has higher net worth because they took a big risk when they leveraged into the house with 20% down.

The renter’s $64,000 was growing steadily at 5% per year. However the buyer put their $64,000 into the $320,000 house which started to grow at 3% per year. The difference in appreciation is so large it dominates the outcome.

Limits of this Experiment:

These simulations don’t account for taxes. On the income side we could simply boost the income to compensate for taxes, so in a sense that is a wash. However, the buyer likely gets a tax break on the mortgage interest and real estate taxes. That lowers their overall tax rate - something the renter can’t take advantage of.

This simulation assumes the house will go up in value 3% per year, which is slightly ahead of inflation. That may or may not be realistic. In a recession or depression the home value is likely to drop. The buyer may someday find themselves underwater (owing more than the home is worth). That said, over a 30 year period the effects from boom / bust cycles may be a wash. A 3% growth per year seems conservative.

This is just one simulation picked out of thousands of possible scenarios. In this particular simulation the buyer wins (even though they had to do tons of upkeep and pay for a furnace and roof)... but that isn't enough to use the finding of this blog post as a blanket statement. You'll have to enter your own numbers into the simulator to analyze your situation.

So is It Always Best to Buy?

If you are planning on living in the same area for more than a decade and your credit and income are good enough for you to qualify for a mortgage, buying a home is probably a better financial move than renting. That doesn’t mean, though, that it’s always the best move for everyone. For example, if you don’t plan on staying in a place long-term, buying might actually be a poor financial decision because selling a home can run as much as 10% for the broker fees, title insurance, repairs, taxes, etc.

Buying also might not be possible. In some places, finding a $2,000 / month rental is entirely doable but there are no homes available that would cost less than $320,000. That puts homeownership out of reach for someone who earns $60,000 per year. Not to mention having 20% down is a major hurdle.

Buying a home might be the "American Dream", but for many young people it’s been an elusive dream, at least more elusive than it was for their parents. In fact, not all young people think that buying a home should even be a dream at all. The decision to buy a home comes down to risk tolerance, access to funds, and finding the right place. The net return is based on where the macro economy is going and how well the neighborhood does.