How Much Is "Enough" for Retirement?

- September 2, 2017

- by Emily

Most of our savings goals are attached to a specific number. We might need $2,000 for a vacation or $40,000 for a down payment on a house, but either way, it’s obvious when we’ve saved the money we set out to put away.

Retirement is not so straightforward. It’s common to hear that you should save for retirement, but those admonitions are rarely pegged to a concrete dollar amount.

So how much is, in fact, enough? It is both complicated and simple to figure out. It primarily depends on your expenses and how long you live. The more frugal you are, the less you need in savings. The longer you plan to live, the more money you’ll need to cover ‘future you’.

How much you need saved up to retire also depends on what you will get from social security and other sources like pensions. Your social security check directly offsets how much you need to withdraw from your retirement account. If you are fortunate enough to have social security pay 100% of your expenses, on paper you need zero savings to retire! However if you have no social security or pension (or don’t have faith those programs will still be around by the time you retire), then you’ll probably need at least 25 times annual expenses saved (for a < 4% withdraw ratio, but more on that later).

Calculators

If you just want to play with some calculators the tech staff at Wealth Meta have created, try these two:

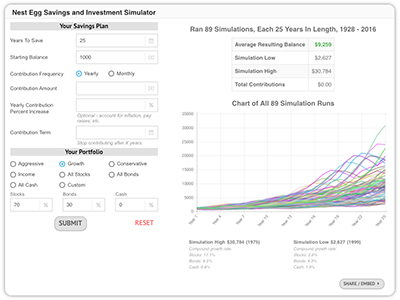

Nest Egg Savings and Investment Simulator - use this calculator if you are still saving for retirement and want to know what your nest egg could be worth when you do finally retire.

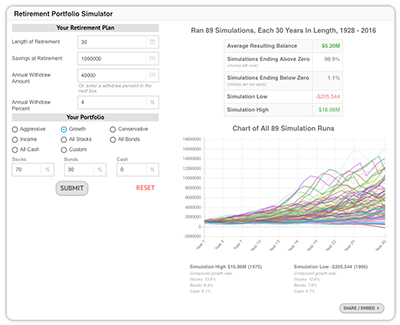

Retirement Nest Egg Simulator - simulates how a retirement nest egg would fare using historical data.

Your Expenses in Retirement

It might seem odd to think about a budget for yourself 30 years in the future, but creating a successful retirement strategy is all about budgeting your future expense. The first step in figuring out how much money you need to retire involves figuring out how much you’ll be spending every year in retirement.

Here are the major categories to think about:

- Housing. Will your mortgage be paid off? How much do property taxes cost and are they likely to increase substantially? How much do you generally spend on home repairs? If you are a renter, how much is your rent and is it likely to increase?

- Healthcare. How much will it cost for you to buy health insurance?

- Other basic expenses. How much are you likely to spend on transportation, food, utilities?

- Entertainment. Many people talk about spending their retirement traveling the world. If you have expensive plans for your retirement activities, think about how much you would spend on them per year.

It’s important to be realistic when you’re coming up with your retirement budget, and keep in mind your current lifestyle. If you tend to be pretty frugal now, it’s safe to plan for a frugal retirement. But if you like expensive cars and have extensive post-retirement travel plans you’d be doing yourself a disservice to assume you’ll suddenly enjoy shopping at Goodwill once you turn 65. Use your current lifestyle as a jumping-off point, while taking into consideration things that will be different 30 or 40 years from now.

Years of Retirement

The truth is, no one knows how long retirement will last, because no one knows when death will come. So determining how many years of retirement to budget for involves deciding what age you want to retire at and then making a bet on when you think you’ll die.

A longevity calculator can help you decide how many years you should budget for. A 65-year-old woman in average health, for example, has a 25% chance of living another 32 years. It’s smart to budget for a best-case-scenario, in terms of longevity, but the exact number of years you’ll budget depends on how much risk you’re comfortable with.

So How Much?

I’ll work this out for myself. For housing, I expect to have paid off my mortgage by retirement. I’ll still have housing expenses from insurance and taxes, which I would estimate will come to around $1,000/month by the time I retire. This is a crude estimate of how much my property taxes and insurance will be in 32 years, because right now they are about $400/month.

How much I’ll pay for healthcare as a retiree is even harder to predict, but I’m going to budget $500/month. This is a crude estimate. At the moment, the most basic Medicare plan is free for retirees who have worked at least 10 years, but there are additional premiums for prescription coverage, supplemental insurance or private Medicare providers.

For other expenses, taking inflation into account, I’d budget another $1,000/month. Note that I’m quite frugal and actually do shop at Goodwill. This is the equivalent of about $600 in today’s money.

As far as other activities? Well, the only thing I love spending money on is travel. I’d be comfortable budgeting $500/month for travel and other fun.

That leaves me with about $3,000/month in expenses, or $36,000 per year, after taxes. How much taxes will I pay? If I put my savings in a Roth accounts the withdrawals are tax free. If it’s a traditional IRA or 401(k), however, withdrawals will be taxed as income, so I’ll actually need to withdraw more each year. To make things simple, let’s assume I’ll need $42,000 per year in retirement.

Calculating how much is needed for retirement:

A simple approach is to multiply the amount of money needed per year by the number of years you’ll be retired. For example, if I’ll need $42k per year, and I’ll live 30 years, that calls for $1,260,000. With this approach, I need to make sure my retirement funds are not eroded by inflation. Consider that in 25 years, $42k won’t go nearly as far as it does today in terms of actual groceries, rent, health care, etc. Starting with $1,260,000 I could allocate my money towards the conservative side of the investment spectrum (fixed income funds, CDs, some bonds, few stocks).

Another way to look at it is - what percent of your portfolio you plan to withdraw from your account? The famous Trinity study showed that a 3-4% withdrawal rate is a ‘safe’ place to be assuming a conservative allocation (some stocks, some bonds, not much cash). With the percentage withdraw approach, I’d be comfortable having around $1.1 million in my retirement accounts at age 65 (I’d be making an annual withdrawal of about 3.75%).

The tech team at Wealth Meta created a calculator that uses historical data to compute a nest egg’s performance in retirement. It lines up with the Trinity study, but lets you plug in various decisions such as your portfolio allocation, how long you’ll live, etc. The calculator accounts for inflation and major historical events like the great depression. Keep in mind with calculators like these, past performance doesn’t guarantee anything. The interesting thing is how much luck plays a role in the final numbers. It can all depend on when you retire and what else is going on in the world!

The bottom line is that exactly how much you need to check “save for retirement” off your to-do list is personal—but it’s probably a larger number than you think.