Using the Income and Spending Simulator to Meet Your Financial Independence Goals

- October 14, 2017

- by Emily

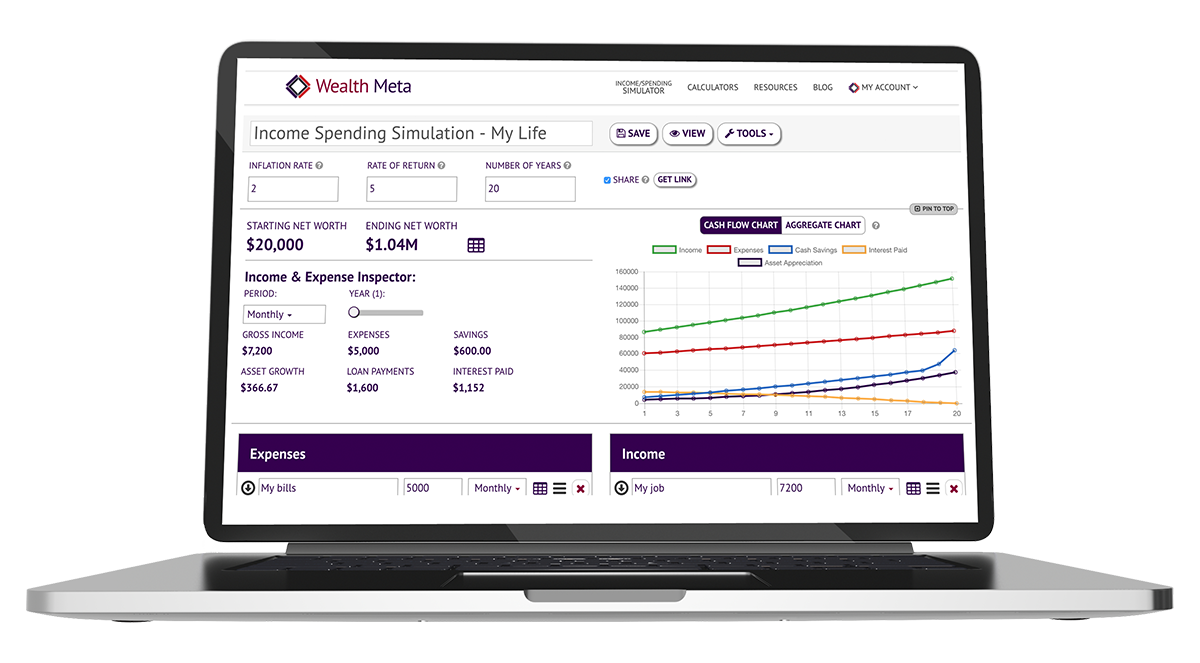

Do you dream of retiring before your knees start failing? That’s the goal for people interested in FIRE, or financial independence and retiring early. Retiring young is entirely possible, but requires hard work, a certain amount of frugality and, above all, planning. If you’re interested in FIRE, our Income and Spending Simulator can help you develop a strategy for financial independence. The walk through below details my own personal finances as a single mother currently living abroad (view my simulation here).

A roadmap is essential to successfully retiring early and achieving financial independence. With the Wealth Meta simulator, you’ll be able to see how different financial choices such as what jobs you take, how you spend, and where you live help (or hurt) you meet your savings goals and, yes, potentially retire early—even very early.

What’s the idea behind FIRE (financial independence / retire early)?

Getting out of the rat race is something that many aspire to, but not everyone has the discipline to do it.

The basic idea of FIRE is have enough money save and invested such that it covers your living expenses for the rest of your life. There are two sides to it: how much you spend and how much you have saved. The less you spend the sooner you can retire. The more you have saved up, the larger your budget can be in retirement.

A quick rule of thumb is a 4% withdrawal rate is a good place to be (see the Trinity Study, and Retirement Nest Egg Calculator). Note that figure is entirely based on past performance which is not an indicator of future performance.

Using the 4% rule of thumb, if you want to live on $80,000 per year, you'd need about $2M saved up. Or if you have $1.5M saved up, you can pretty confidently withdraw $60,000 per year and not have to worry about going broke. Of course reality over the next 30-50 years may turn out to be pretty different.

Breaking it down further:

Looking at spending and net worth provides generalized (perhaps idealized) guidance for retirement. One of our core values at Wealth Meta is to be thorough. Our tools reflect that. The Income and Spending Simulator looks at four areas: expenses, income, loans, and all important assets.

Here’s a breakdown of how I used the Income and Spending Simulator to get an accurate picture of where I am now and how things might look in the future in all of these categories. I've shared the results and you can view the entire simulation here.

Expenses

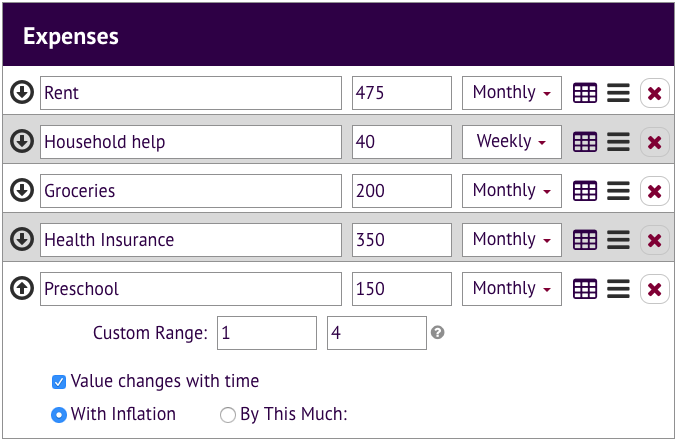

Use the expenses category to log all of your expenses. If you want to get a good picture of your financial life, you need to input every single one of your expenses. One of the key tenants of achieving financial independence is to whittle your expenses down to the minimum so that you can put a huge chunk of money away towards financial freedom every month.

I’ve recently relocated to Nicaragua, so my expenses are fairly low, considering. Still, when I plugged in all of my expenses, I came up with $1,583 / month. That’s with the real (although rounded / estimated in some cases) amounts I’m spending.

It would be naive to think that my expenses will remain the same forever. I’m not going to be paying for preschool once my daughter is ready to go to public school, for example. On the flip side, if/when I we go back to the United States, I’ll likely be paying a lot more for rent, utilities and transportation.

Even if you don’t anticipate any major changes to your expenses, they will change because of inflation. Simulating changes due to inflation is easy: Just click on "value changes with time" and choose "with inflation." Or you can put in a specific amount or percentage that the expense category is likely to change, by year. In the case of the Preschool line above, I've indicated it will grow with inflation (since tuition always seems to go up) and I've given it a custom range from years 1 - 4 of since my daughter will likely go to public school when she is five years old.

If financial independence is your goal, you’ll probably want to start cutting back on your expenses. Use the tool to see what would happen to your net worth in five, 10 or 15 years if you cut back or eliminate certain expenses. Compare mode, located in the tools menu in the upper right allows you to exclude, add, or adjust expenses and see the before and after.

Income

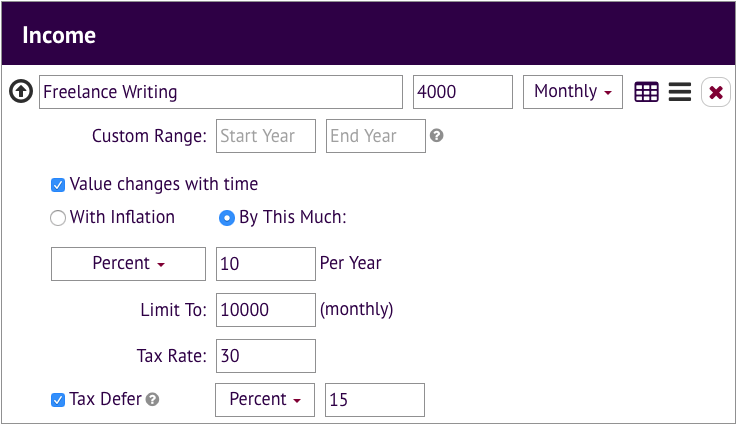

When we think about our financial situation, most of us focus (sometimes excessively) on our income. There’s no doubt that income is important, even if it is only a part of the whole financial picture. For most people working towards early retirement, increasing income is a key part of being able to save and invest enough money to stop working early.

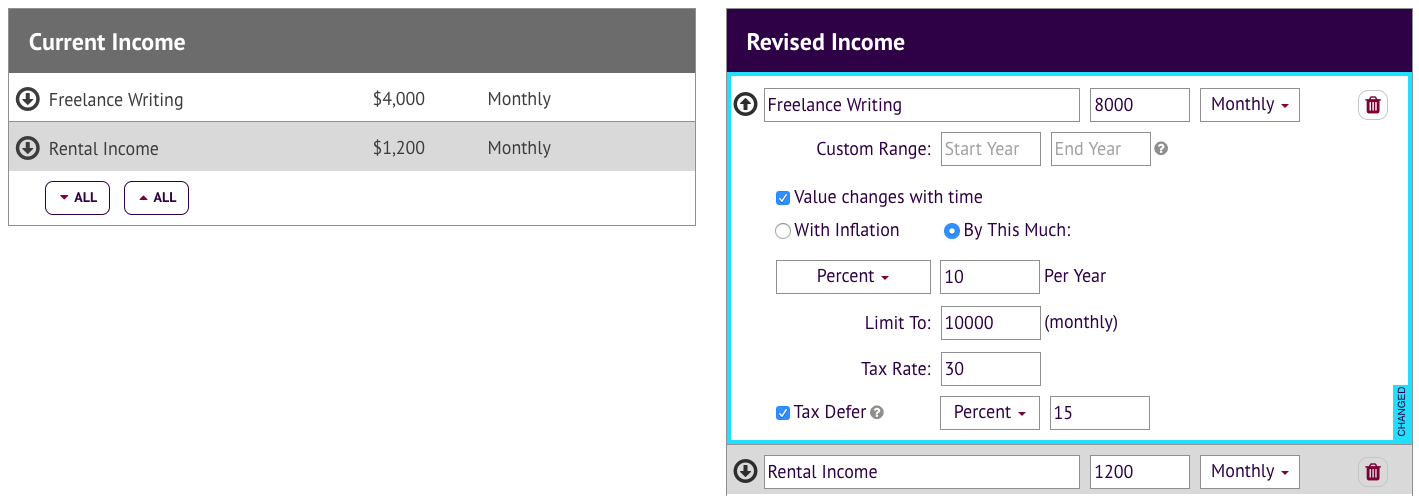

In my case, I currently have around $4000 / month in income from my freelance writing work. If that income remains flat, given my expenses, I’ll have a net worth of about $475k in twenty years—probably not enough to retire on (I also haven’t accounted for my student loans yet). If my income increases, but just at the rate of inflation, I’d have ~$685k in net worth in 20 years.

What about if my income increases by a certain percentage each year? I've set the simulator to increase my income by a relatively modest 10 percent per year until it caps out at $120,000 annually. I think that figure is attainable but I wouldn't want to be working more than that. Now the simulation tells me my ending net worth is $1.55M!

When you’re looking at income, it’s also important to account for taxes. Taxes are complicated, and get even more complicated if a certain amount of your income is in tax-deferred accounts. If early retirement is your goal, however, you likely aren’t going to want to use tax-deferred retirement accounts that you can’t access until after age 55. I've entered a tax rate of 30%, and I've chosen to defer 15% of my annual income into a retirement account. With the deferral it brings my ending net worth to $1.70M thanks to the tax savings that brings.

Loans

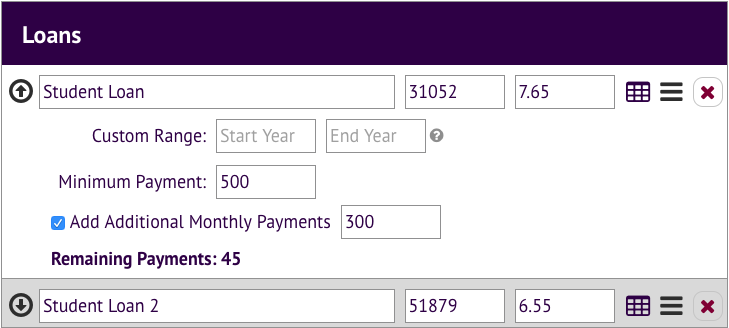

For most people pursuing FIRE, eliminating debt is the first step towards financial independence.

Like many people my age, I have a huge amount of student loans. Adding them into the financial simulator takes a pretty big bite out of the amount I’m able to save every month. Interestingly, though, on a twenty-year time scale I can still amass a net worth of $1.44 million, assuming I’m increasing my income until I hit $10,000 per month, and defer 15%.

The simulation also tells me how making additional payments on my loan will affect how many payments I'll have to make and how soon I can be debt free. I've elected to pay ahead on my highest interest loan to speed up getting out of debt.

Assets

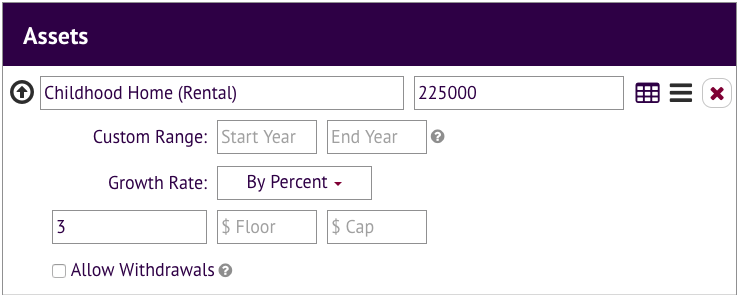

The final part of building your FIRE strategy is managing your assets. If you already own real estate or have a stock portfolio, you can put them into this category. I actually do own an asset, which I’ve left out of the simulator for now: My late mother’s house, which I co-own with my sister. I've also left off my emergency fund since I don't count it towards my net worth.

We have tenants in our house at the moment and we also have a mortgage to pay. So accurately accounting for my house in the income / spending simulator requires entering information in all of the simulation categories.

For expenses, the property taxes are around $4500 / year. Our property manager charges $240 / month, we pay about $50 / in landlord insurance and have $300 / month budgeted for repairs. All of those expenses are shared with my sister, so I’m inputting half of those amounts in my own simulation.

We charge $2400 in rent, so that’s income (although just $1200 of that is “my” income). We also have a mortgage (I’ve included half of the total mortgage amount and half of the monthly payment). I’ve also included half of the home value, since only “half” of the asset is actually mine.

Adding in my asset does two things, in my case. First of all, it brings my starting net worth into the black, which feels nice. It also increases my ending net worth to $1.91 million.

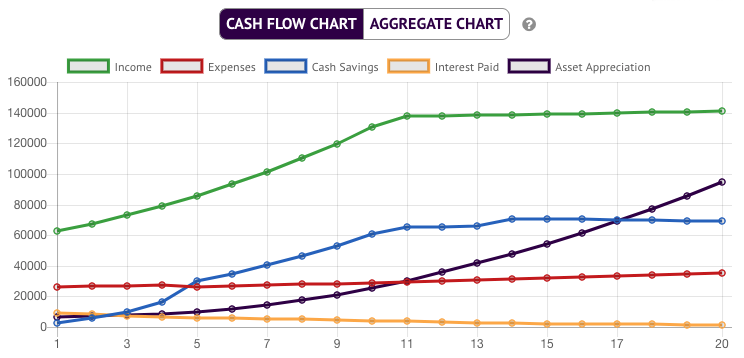

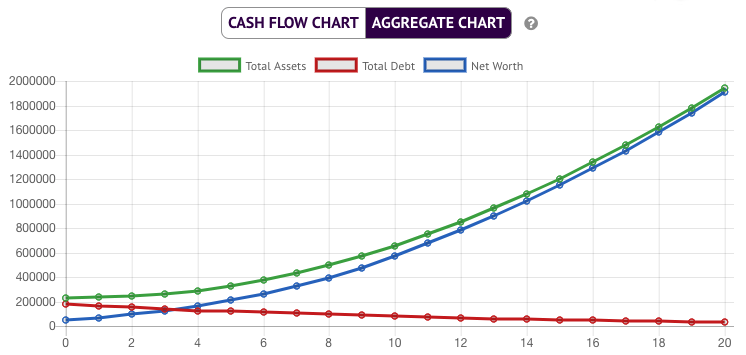

Here is how the charts the simulator produces are looking in my case:

What Do I Need to Retire in Five Years?

Most people thinking about FIRE aren’t working on twenty-year timelines, they’re thinking about retirement in five or ten years. Now that I’ve established where I am now, I can use the simulator to figure out what I’d need to do in order to retire in five years.

First of all, though, I’d need to decide how much money I need at the time of retirement. I’d like to have at least $30,000 per year—that allows me a bit more wiggle room than my current expense level. If I’m getting a 6 percent rate of return, I can safely withdrawn 4 percent per year, so I need $750,000 saved in order to retire.

So how do I get to $750,000 in five years?

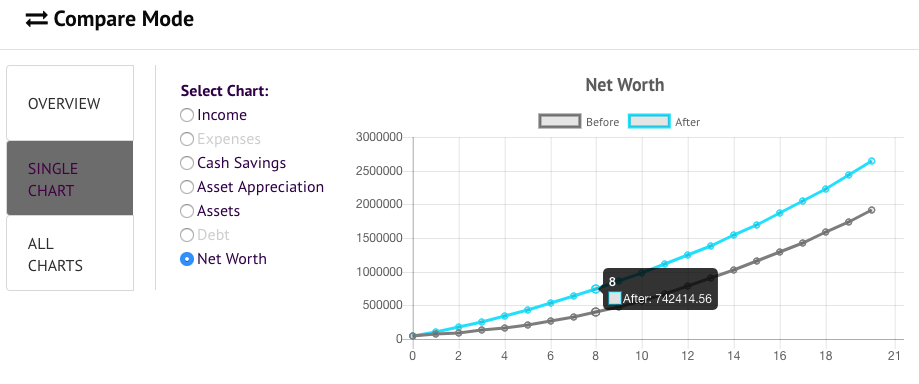

If I go under Tools -> Compare... I can start to play with different income scenarios. Let's say I double my income tomorrow? That gets me to a net worth of about $742k in 8 years, not too bad.

What if I do that and stop going to the expensive pool around the corner, stop paying for house cleaning, and reduce my rent by $175/ month? That gets me to $797k in 8 years. Let’s face it, I’m probably not going to do any of those things.

But, in ten years, I’d be at $979k—enough for retirement at age 40, and without skimping on necessities like health insurance or luxuries like swimming pool memberships. This does require doubling my income sooner rather than later—a goal that I know is within the realm of possibility but will take some hustle.

Why You Need a Detailed Simulator

When you’re making your FIRE escape plan, it’s important to get an accurate look at your current finances as well as a realistic picture of what you’ll need to do in order to get to financial independence.

No simulator is perfect, and I’m probably underestimating my expenses in a few areas, plus under accounting for emergencies, vacations, and life in general. Still I used a conservative rate of return, and a fairly long time horizon to grow my income. In any case it is impossible to predict with 100 percent accuracy rates of return, inflation rates and how quickly your assets with appreciate. However, the Wealth Meta simulator can help you take a number of factors into account when you’re creating your FIRE plan, and help you develop realistic expectations about how and when you’ll be able to reach financial independence.

Again you can view my simulation here and even play with your own copy.