The Time Value of Money

- March 6, 2017

- by Steven

How well do you think you know money? Money in hand is great, but at what point is it smarter to defer and receive a larger amount in the future? Here's a challenge for you...

Imagine you’re choosing between the following two options:

Option A: Accept $100 dollars today, which you must deposit into a risk-free savings account that earns 10% annual interest. And only after one year goes by can you withdraw and spend the money.

Option B: Accept $109 today, which you must deposit into an account that pays no interest. And again only after one year goes by can you spend the funds.

Assuming your goal is to have more money, what’s the better option?

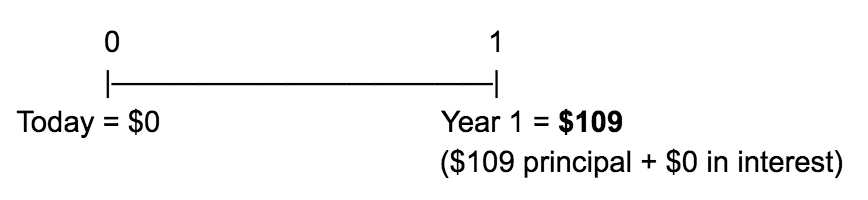

If you opt for Option A, with 10% interest, your timeline looks like:

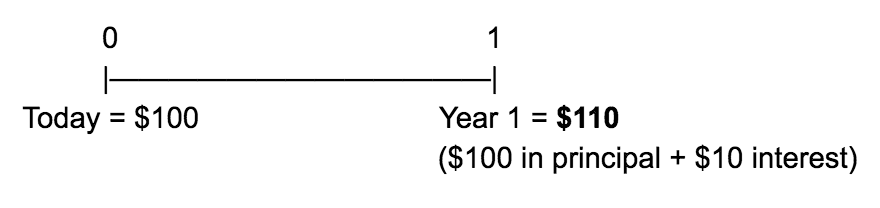

If you opt for Option B, with 0% interest, your timeline looks like:

Judging from the timelines, the better option is Option A because $110 is greater than $109. Option A earned interest and Option B did not.

What is the time value of money?

What the above challenge illustrates is the time value of money—a fundamental concept in the discipline of Finance. And one that’ll serve you well as you climb towards Financial Freedom.

For a video introduction to the time value of money, I point you to this discussion by finance professor Gautam Kaul of the University of Michigan.

The time value of money is the idea that, assuming positive interest rates, a dollar today is worth more than a dollar tomorrow. Because you have the option to earn interest on any money you invest today.

For example, the time value of money means that if your employer gives you the option to...

- split your monthly salary into two paychecks per month, say, half to be received on the 15th and the other half at the end of the month

- or to receive one paycheck in full at the end of the month

...you know to choose two paychecks because you can invest the check you receive on the 15th to start earning interest on it.

The time value of money also means that if you know you’re going to receive a tax return in a given year, it behooves you to file your taxes as soon as possible so you can receive your return and invest it.

Likewise, if you know you owe money to the IRS, the better play is to wait as long as possible to pay Uncle Sam. Because your money can grow in the interim.

The key point is that a dollar in your hands today is worth more than a dollar in your hands tomorrow since our financial system is structured in such a way that money can grow on money by way of interest accrual and dividend reinvestments.

And now that you’ve been exposed to this concept, you’ll see examples of it all around you.

Besides the notion of a dollar today is worth more than a dollar tomorrow, the time value of money gives us several interesting insights:

1: You can’t compare money across time without knowing interest rates

What this means is that you can’t confidently say $500 dollars one year from now is worth more than $499 dollars today given that you can earn interest on the $499 during the year (not to mention anything of inflation and other risk factors).

This insight gets at the important concepts of Present Value (PV) and Future Value (FV). You might be interested in learning more about PV and FV because having them in your toolkit of financial knowledge will make you a smarter investor. And if you understand these concepts (including compounding), you’ll probably be in the top 1% of financial savviness.

To learn about PV and FV, I recommend Coursera’s Introduction to Finance course led by a fantastic professor, Gautam Kaul of the University of Michigan.

2: Time inherently has value.

“Time is money.”

The mere passage of time carries value because, again, you can collect interest (and dividends). And if you invest regularly and keep your fees low, time will bear that delicious, juicy fruit of Financial Freedom thanks to compounding, what Albert Einstein dubbed the Eighth Wonder of the World.

3: Sacrifice today for gains tomorrow.

If you want to benefit from compounding (and thus the time value of money), you must forgo spending today (meaning you invest money to buy freedom instead) so you can become financially free tomorrow.

You see this insight play out in the real-world as most things in life worth striving for—truly worth striving for—tend to be hard and require sacrifice. When you think of your life, are the best things in it not the ones that demand some amount of initial pain (time, energy, effort) today in order to realize the benefits tomorrow?

4: Value resides in the future

The takeaway here is since time carries value, you must look into the future when making investment decisions. For a deeper understanding of this principle, I refer you to: net present value and discounted cash flow.

What might seem like an obvious point is quite profound because it reminds us that all decisions impact the future. As you navigate investing—and life—and make decisions, you must be aware of the present but you always orient yourself to look out into the future. Thus you keep moving moving forward and you don’t look to the past. The past is interesting insofar as we can learn from it. But the past is the past. It’s over. Anything we learn from it must be factored into an analysis that considers the future because that’s where value resides.

"Don’t saw sawdust" as Dale Carnegie says. And keep moving forward.

Notes:

- Remember that all investments are subject to risk, including the possible loss of the money you invest.

- Definition of time value of money (a dollar today is worth more than a dollar tomorrow) comes from Coursera’s Introduction to Finance course

- Khan Academy - Time Value of Money

- Time Value of Money, Wikipedia