Playing the Credit Card Reward Game—How to Make It Worth It

- November 8, 2017

- by Emily

Rewards cards can be a net win (3% on spending is a reasonable goal). They only pay off if you know how to use them correctly and have the right attitude going in. Here are some things to consider if you’re thinking about getting a rewards card.

It’s a Game—and You’re Playing to Win

You’re participating in a game whenever you get a credit card, but that’s especially true with rewards cards. Don’t expect that you’ll be taking free intercontinental flights every three months without putting in any effort. It’s possible to rake up that many points, but the people who do so generally describe getting free flights from credit cards as one of their hobbies. Businesses with lots of cash flow (and lots of expenses than can be put on a credit card) can rack up points quickly. If you own a retail store and can put orders for inventory on a credit card, for example, you might be able to rack up lots of points. If, on the other hand, you’re just putting your household expenses, groceries and the occasional night out on your card, it will be harder to win the rewards card game. Manage your expectations about how much time it’s taking and how much money you’ll save. If you’d rather spend that time on another hobby—or perhaps doing paid work to full price for your flights—maybe a rewards card isn’t the best idea after all.

Pay off Your Balance Every Month

Generally speaking, most reward credit cards have a higher interest rate than non-rewards cards. So if you are looking to maximize your total benefit you should only use them if you know you’ll be able to pay off your balance every month. They also often have annual fees, unlike many non-rewards cards. Sometimes they will waive the annual fee for the first year only - watch out for that gimmick to suck you in.

If you carry a balance on your credit card, a rewards card likely isn’t for you, because you’ll end up paying far more in interest than you’ll get back in rewards.

Choose Appropriate Rewards

Credit card rewards come in many shapes and sizes. Some common types of rewards include:

- Cash back

- Free or discounted flights and hotels

- Discounted gas prices

- Points you can redeem for shopping at certain brands / stores

It’s important to choose the best type of reward based on your lifestyle. Everyone can use cash, so choosing a cashback card is often the simplest option. However, the value of your rewards will generally be greater if you’re getting free flights or hotels instead of cash, so if you like to travel that could be a better option.

Read the Fine Print

Remember, you’re playing a game, and it’s a zero-sum game—you want to get more out of it than you put in, while the credit card issuer hopes that the opposite happens. Like any other game, you need to understand the rules if you have any hope of winning. When it comes to rewards cards, the rules are in the fine print. When you’re reading the fine print, make sure to pay attention to the following common caveats:

- What is the minimum amount you need to charge to the credit card before you start accruing rewards?

- What is the annual fee, and does it change?

- Do the rewards expire, and if so, when?

- Do you lose all your rewards if you miss a payment?

Don’t Overspend Just To Get Points

There’s always the danger of getting so caught up with chasing rewards that you buy things that you wouldn’t have otherwise. Rewards cards only make sense if you’re using them to pay for things that you would buy anyway. This is especially true if you end up buying something you don't need, and end up paying interest on it because you were not able to pay off the card in full at the end of the month.

Resources for Finding a Credit Card That Maximizes Points / Benefits:

If you’re shopping for a new credit card, you’ve likely already spent hours wading through the countless different offers, each one with a different interest rate, fee structure and issuing bank.

A few sites offer advanced search tools to help you find the perfect card. They allow you to enter your monthly spending and optimize the rewards against it. Again, read the fine print and confirm what the bank says about the offer (since that is what you are actually agreeing to). These sites make money off you when you apply for a card after clicking a link from their site. However, Wealth Meta isn't getting any compensation by listing the following resources.

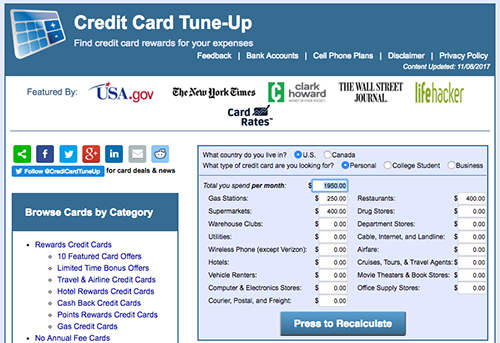

- Credit Card Tune-Up

This one optimizes spending across up to 3 cards.

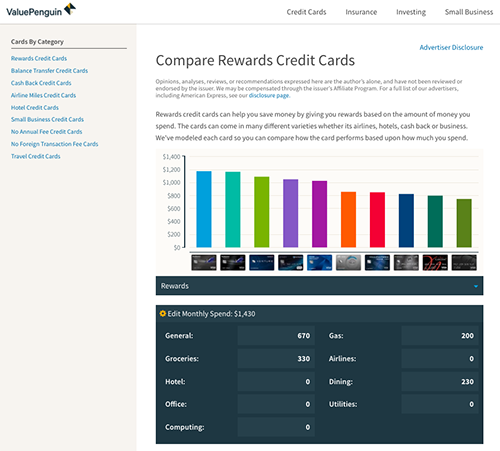

- Value Penguin

They have categories for hotels, airlines.

- If you know of another resource for finding credit cards with rewards let us know and we’ll add it.

The bottom line is that rewards cards probably aren’t going to change your overall financial picture, but they can provide a small built in discount on everything you buy (2-3% is pretty normal). Just make sure that you know the rules of the game before you try to beat the house.